SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The cost of solar energy technology is expected to fall within the next decade, giving a boost to the industry. (Photo: Oregon Department of Transportation/flickr/cc)

As an increasing number of nations make plans for banning gas and diesel vehicles within the coming decades, and drivers gain an awareness of the benefits associated with electric vehicles, researchers are prediciting notable consequences for dirty energy sources as the public shifts toward favoring renewable alternatives.

"Post-2025, that's where electric car sales take off. The further you go into the future, the more it's electric cars," Alan Gelder, a senior analyst for the research group Wood Mackenzie, told the Guardian. "If cities began banning cars with a combustion engine, that would rapidly accelerate the switch to electric vehicles."

Drivers transitioning to electric vehicles out of necessity, because of such bans--which multiple European nations plan to implement in the next 15-25 years--and efforts by governments to increase fuel efficiency regluations, is only part of what is fueling the blossoming electric vehicle market.

Auto manufacturers are also taking cues from the increased demand due to bans and enhanced regulations as well as consumer desire for more environmentally friendly vehicles, as Business Insider detailed in May.

These efforts by governments to limit emissions and by automakers to meet the rising demand for electic vehicles are expected to substanitally impact the oil and gas industry in the coming years.

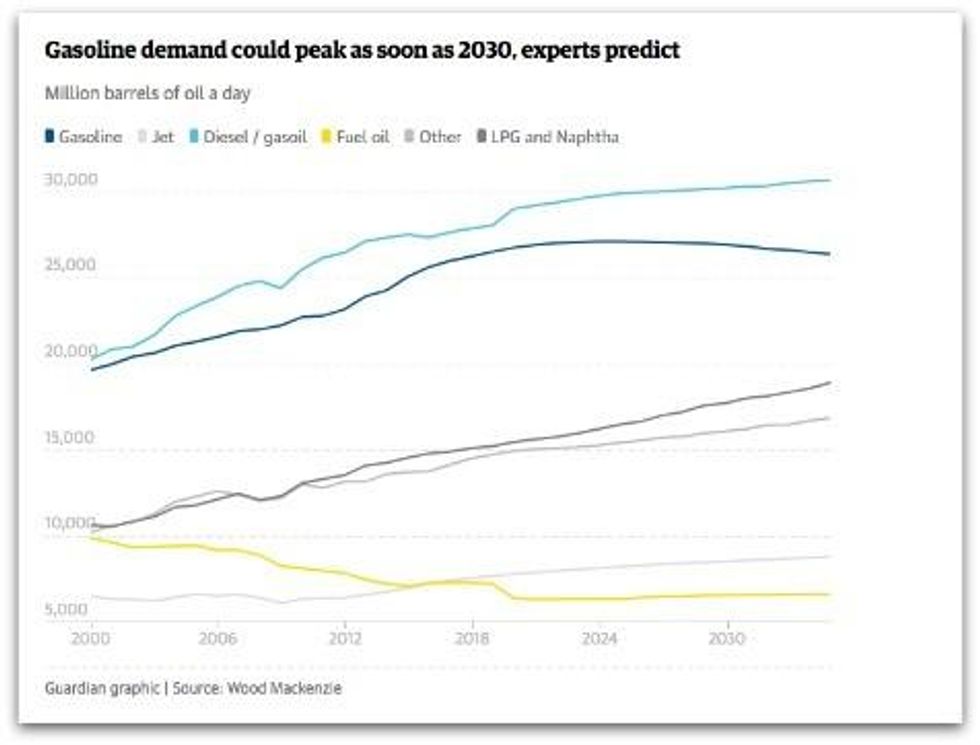

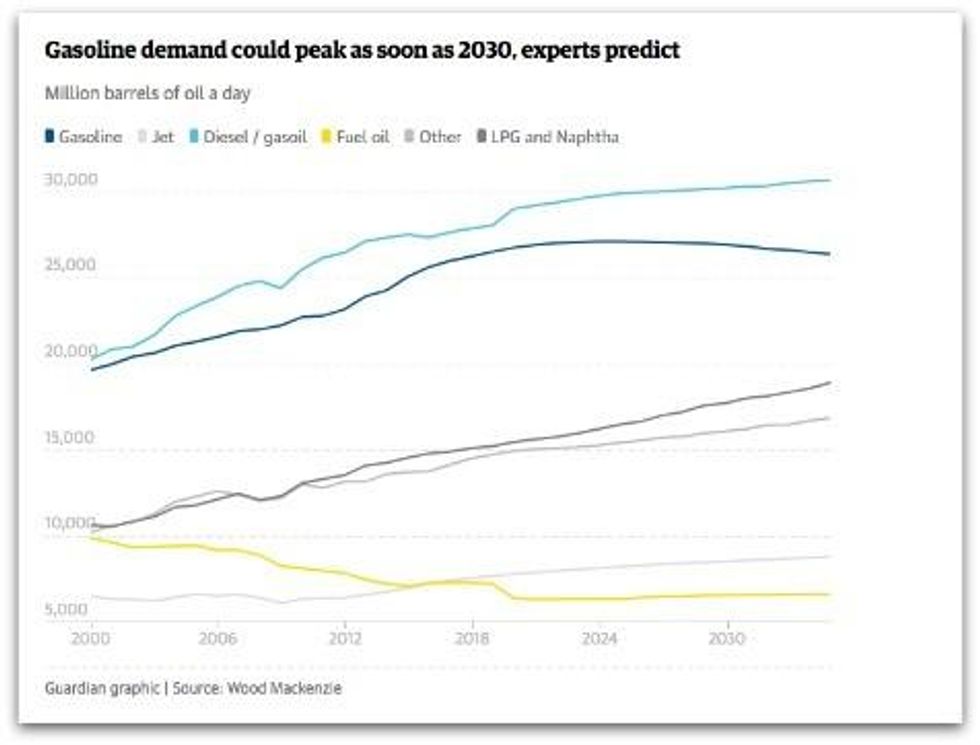

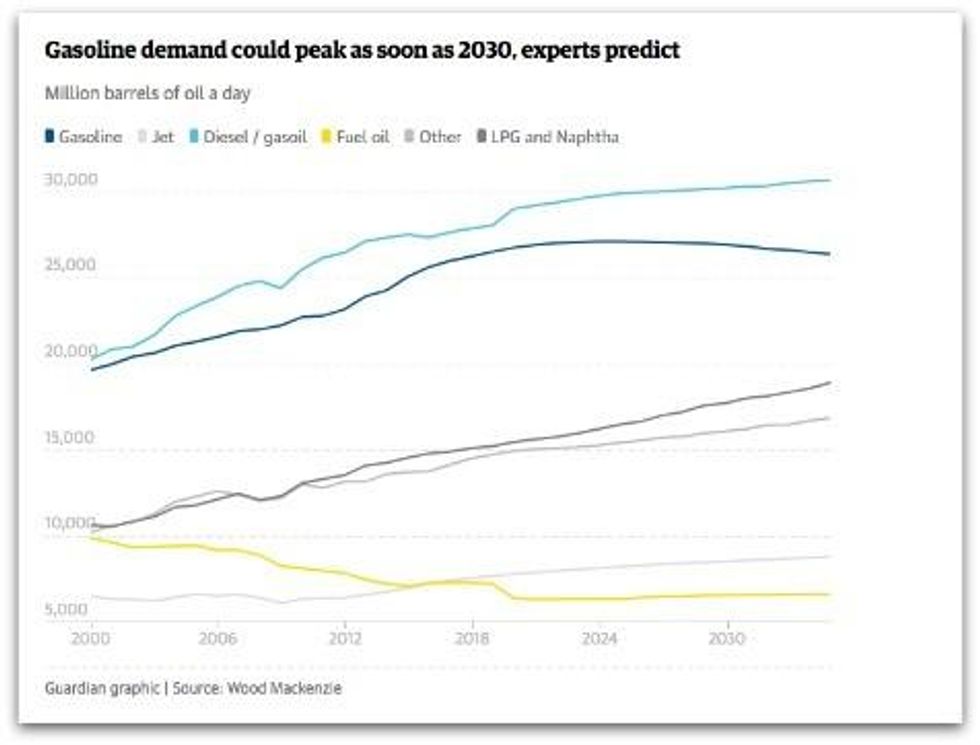

Wood Mackenzie estimates global gasoline prices will peak then start to fall by 2030, though Gelder posits "the ripples of gasoline's plateau would be felt much earlier," as fossil fuel companies take fewer investment risks once demand for gas ebbs.

"While gasoline will peak first," the newspaper notes, "the analysts expect total oil demand to plateau about 2035, as growth is hit by climate change policies and developing world economies maturing."

Meanwhile, the oil and gas industry is also taking a hit from the solar energy market--which is booming in the U.S. and elsewhere, and is expected to continue doing well over the next decade. The head of the International Renewable Energy Agency (IRENA) told Reuters the industry expects the costs of solar power to fall a notable amount over the next 10 year.

"In the next decade, the cost of (utility scale) solar could fall by 60 percent or more," IRENA director general Adnan Amin said.

The Trump administration is currently weighing whether to increase taxes on imported solar materials, after the U.S. International Trade Commission determined in September that cheap imports had been harmful to U.S.-based solar companies.

Amin criticized the possible increased taxation as short-sighted, considering the growing global demand for solar products and renewable alternatives to oil and gas.

"It's not always the best strategy to try to protect your industry and have high prices," Amin said, "because in the long-term what you want to do is drive down the cost of energy."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As an increasing number of nations make plans for banning gas and diesel vehicles within the coming decades, and drivers gain an awareness of the benefits associated with electric vehicles, researchers are prediciting notable consequences for dirty energy sources as the public shifts toward favoring renewable alternatives.

"Post-2025, that's where electric car sales take off. The further you go into the future, the more it's electric cars," Alan Gelder, a senior analyst for the research group Wood Mackenzie, told the Guardian. "If cities began banning cars with a combustion engine, that would rapidly accelerate the switch to electric vehicles."

Drivers transitioning to electric vehicles out of necessity, because of such bans--which multiple European nations plan to implement in the next 15-25 years--and efforts by governments to increase fuel efficiency regluations, is only part of what is fueling the blossoming electric vehicle market.

Auto manufacturers are also taking cues from the increased demand due to bans and enhanced regulations as well as consumer desire for more environmentally friendly vehicles, as Business Insider detailed in May.

These efforts by governments to limit emissions and by automakers to meet the rising demand for electic vehicles are expected to substanitally impact the oil and gas industry in the coming years.

Wood Mackenzie estimates global gasoline prices will peak then start to fall by 2030, though Gelder posits "the ripples of gasoline's plateau would be felt much earlier," as fossil fuel companies take fewer investment risks once demand for gas ebbs.

"While gasoline will peak first," the newspaper notes, "the analysts expect total oil demand to plateau about 2035, as growth is hit by climate change policies and developing world economies maturing."

Meanwhile, the oil and gas industry is also taking a hit from the solar energy market--which is booming in the U.S. and elsewhere, and is expected to continue doing well over the next decade. The head of the International Renewable Energy Agency (IRENA) told Reuters the industry expects the costs of solar power to fall a notable amount over the next 10 year.

"In the next decade, the cost of (utility scale) solar could fall by 60 percent or more," IRENA director general Adnan Amin said.

The Trump administration is currently weighing whether to increase taxes on imported solar materials, after the U.S. International Trade Commission determined in September that cheap imports had been harmful to U.S.-based solar companies.

Amin criticized the possible increased taxation as short-sighted, considering the growing global demand for solar products and renewable alternatives to oil and gas.

"It's not always the best strategy to try to protect your industry and have high prices," Amin said, "because in the long-term what you want to do is drive down the cost of energy."

As an increasing number of nations make plans for banning gas and diesel vehicles within the coming decades, and drivers gain an awareness of the benefits associated with electric vehicles, researchers are prediciting notable consequences for dirty energy sources as the public shifts toward favoring renewable alternatives.

"Post-2025, that's where electric car sales take off. The further you go into the future, the more it's electric cars," Alan Gelder, a senior analyst for the research group Wood Mackenzie, told the Guardian. "If cities began banning cars with a combustion engine, that would rapidly accelerate the switch to electric vehicles."

Drivers transitioning to electric vehicles out of necessity, because of such bans--which multiple European nations plan to implement in the next 15-25 years--and efforts by governments to increase fuel efficiency regluations, is only part of what is fueling the blossoming electric vehicle market.

Auto manufacturers are also taking cues from the increased demand due to bans and enhanced regulations as well as consumer desire for more environmentally friendly vehicles, as Business Insider detailed in May.

These efforts by governments to limit emissions and by automakers to meet the rising demand for electic vehicles are expected to substanitally impact the oil and gas industry in the coming years.

Wood Mackenzie estimates global gasoline prices will peak then start to fall by 2030, though Gelder posits "the ripples of gasoline's plateau would be felt much earlier," as fossil fuel companies take fewer investment risks once demand for gas ebbs.

"While gasoline will peak first," the newspaper notes, "the analysts expect total oil demand to plateau about 2035, as growth is hit by climate change policies and developing world economies maturing."

Meanwhile, the oil and gas industry is also taking a hit from the solar energy market--which is booming in the U.S. and elsewhere, and is expected to continue doing well over the next decade. The head of the International Renewable Energy Agency (IRENA) told Reuters the industry expects the costs of solar power to fall a notable amount over the next 10 year.

"In the next decade, the cost of (utility scale) solar could fall by 60 percent or more," IRENA director general Adnan Amin said.

The Trump administration is currently weighing whether to increase taxes on imported solar materials, after the U.S. International Trade Commission determined in September that cheap imports had been harmful to U.S.-based solar companies.

Amin criticized the possible increased taxation as short-sighted, considering the growing global demand for solar products and renewable alternatives to oil and gas.

"It's not always the best strategy to try to protect your industry and have high prices," Amin said, "because in the long-term what you want to do is drive down the cost of energy."