The gross slashing of funds for public universities has caused a "surge" in tuition prices, disproportionately impacting low-income students says a new report from the Center on Budget and Policy Priorities (CBPP).

States are spending an average of 28 percent less this year on public university funding than they did in 2008--a decrease of $2,353 per student. According to CBPP, thirty-six states cut funding by over 20 percent and eleven slashed their budgets by more than one-third. Arizona and New Hampshire have cut their higher education spending in half.

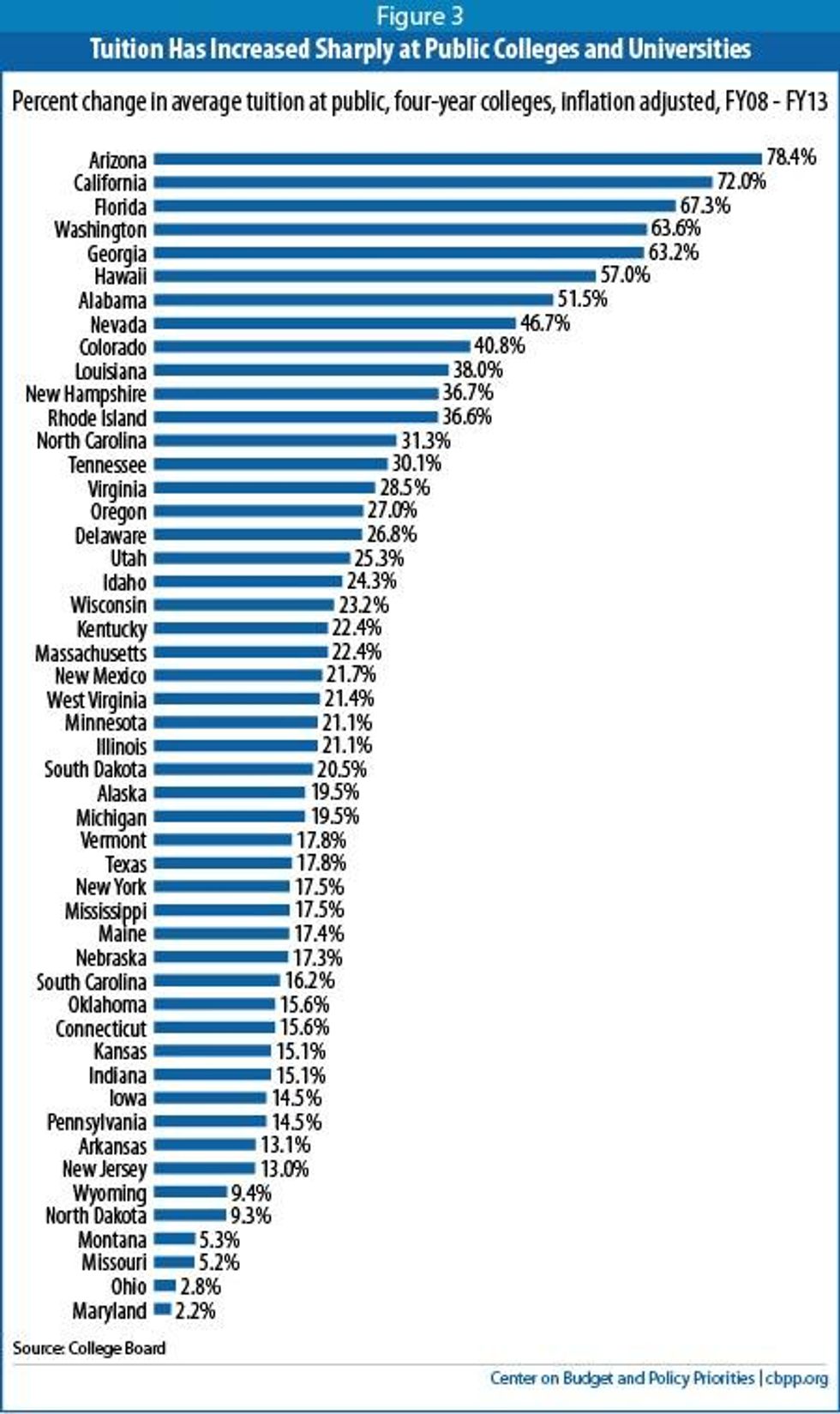

To compensate for this massive gap in funding, the burden of cost has shifted to students in the form of surging tuition which, at four-year public colleges, has grown 27 percent since the 2007-08 year.

"These numbers are a vivid demonstration of why Washington's post-recession path has been so disastrous," said the Atlantic's Jordan Weissman in response to the report.

According to the report:

Average annual tuition at four-year public colleges has grown by $1,850, or 27 percent, since the 2007-08 school year when adjusted for inflation. In seven states -- Arizona, California, Florida, Washington, Georgia, Hawaii, and Alabama -- average tuition has increased by more than 50 percent. In Arizona and California, tuition has risen by more than 70 percent.

"It's very clear that rising costs dissuade students from attending college, particularly students from low-income families," said CBPP policy analyst Phil Oliff on a call with reporters. Citing a 1995 study by Harvard University researcher Thomas Kane, CBPP notes that states that had the largest tuition increases during the 1980's and early 1990's "saw the greatest widening of the gaps in enrollment between high- and low-income youth."

Compounding these rising costs, the rate of growth for public university tuition has outpaced the growth in median household income nearly 159 to 3 percent between 1991 and 2011, leaving students and families beholden to mounting levels of debt to cover the exploding cost of schools.

According to CBPP:

Between the 2007-08 and the 2010-11 school years, the amount of debt incurred by the average bachelor's degree recipient at a public four-year institution grew from $11,800 to $13,600 (in 2011 dollars), an inflation adjusted increase of $1,800, or 15 percent. The average level of debt incurred had grown from $11,100 to $11,800, an increase of $700, or about 6 percent, over the previous eight years.

"We're going to be living with the effects of these cuts for a long time," added Weissman. "We'll see them in the form of higher student loan bills and students who can't graduate on time, because the classes they needed filled up too quickly."

The report concludes that these disturbing figures will have widespread impacts on an already weak national education system and consequently, states' future economic success. "At the very least," the authors write, "states must avoid shortsighted tax cuts, which would make it much harder for them to invest in higher education, strengthen the skills of their workforce, and compete for the jobs of the future."

_____________________