May, 01 2020, 12:00am EDT

For Immediate Release

Contact:

Jayson O’Neill, Director

Western Values Project

jayson@westernvaluesproject.org

(406) 200-8582

Trump Grants Big Oil Lobby Association's Bailout Wish

Federal Reserve Decision Mirrors Independent Petroleum Association of America’s Request.

WASHINGTON

Yesterday, Trump's Federal Reserve opened the floodgates to big oil in a decision that will allow financially unsustainable oil and gas corporations to pay down their upside-down balance sheets with taxpayer-backed loan monies intended for small and mid-sized businesses. This decision adds to new data from Trump's Treasury Department and Small Business Administrations that revealed over one-third of all extractive resource corporations and related industries have been awarded some $3.9 billion bailout funds through the Payroll Protection Program.

The decision, which also doubles the revenue eligibility cap on Federal Reserve loans to $5 billion in annual revenue and expands employee caps to 15,000, mirrors the request the Independent Petroleum Association of America (IPAA) sent to the Trump administration two weeks ago. Several oil state senators followed the lobby association's lead with a similar request. IPAA is a former client of mega-lobbyist turned-Interior Secretary David Bernhardt and has been exposed bragging and joking about their direct access to the administration.

"Big oil and their lobby arm IPAA are laughing all the way to the bank after the Trump administration handed them another blank check to shore up their upside-down balance sheets," said Jayson O'Neill, Director of Western Values Project. "Once again the Trump administration showed its true colors by serving up another taxpayer-funded bailout to its billionaire big oil corporate pals while ignoring needed help for American families and small businesses."

Western Values Project previously obtained this partial IPAA membership list, which includes the likes of Shell Oil Company and other big oil corporations, through a Freedom of Information Act request. These are not necessarily the 'small and mid-sized producers' the lobbying association tries to brand itself as representing.

Big oil corporations have spent nearly $377 million on federal lobbying since the start of the Trump administration and have showered Trump's campaign with $9.7 million in donations. It's already paid off. Seventeen oil and gas corporations reported $25 billion in direct, one-time benefits from Trump's 2017 tax cuts.

Accountable.US Action released updated information on TrumpBailouts.org about small business awards under the Small Business Administration's PPP. The database includes several corporations that are defined as 'Mining' by the federal government, which includes oil and gas corporations. Accountable.US Action has identified PPP bailouts totaling over $100 million that have gone to big oil, gas, coal, mining, and related industries.

Filings compiled by The Washington Post found that publicly traded corporations have received more than $1 billion in funds meant for small businesses. Nearly 300 public corporations, including 43 with more than 500 workers and several that pay top executives millions in compensation, have reported receiving bailouts through Trump's Small Business Administration.

The Trump administration and the Interior Department have been desperately trying to find ways to bail out big oil and extractive corporations despite the industry's boom-bust cycle and negative balance sheets. The Interior Department is also still plowing forward with oil and gas leasing, with leases often going for less than a cup of coffee, and major policy decisions despite repeated requests for a pause during the pandemic.

Learn more about the special interests fueling the Trump administration at Accountable.US and ongoing efforts to carve out more big oil, coal, and mining bailouts at WesternValuesProject.org.

Trump Administration Bends To Will Of IPAA, Highly Influential Oil And Gas Trade Association And Former Client Of Interior Secretary David Bernhardt

The Trump Federal Reserve Creates A New Type Of Loan, Granting IPAA's Request That The Fed Remove Rules Prohibiting Using The Funding To Pay Down Debts Incurred Before The Beginning Of The Pandemic

Two Weeks Ago, IPAA Asked The Federal Reserve To Change Its Borrowing Rules To Allow Its Members To Pay Down Their Existing Debt Using Main Street Lending Program Funding...

On April 15, 2020, The Independent Petroleum Association Of America Asked The Trump Federal Reserve For "Flexibility" On A Provision Of The Main Street Lending Program Barring Recipients From Using The Funding From "Repaying Other Debts." "The Eligible Borrower must commit to refrain from using the proceeds of the Eligible Loan to repay other loan balances. The Eligible Borrower must commit to refrain from repaying other debt of equal or lower priority, with the exception of mandatory principal payments, unless the Eligible Borrower has first repaid the Eligible Loan in full. IPAA asks that you consider providing flexibility on this provision to otherwise Eligible Borrowers, such as independent producers." [IPAA Letter to the Federal Reserve, 04/15/20]

The Federal Reserve Did Just That, Announcing They Would Offer A New Type Of Main Street Program Funding Allowing Borrowers To Refinance Any "Existing Debt" They Owe To Any Lender...

On April 30, 2020, The Federal Reserve Announced A New Type Of Main Street Program Loans Called "Priority Loans." "There will be a new type of 'priority loan' in which the Federal Reserve will buy 85% of the loan made by a bank, as opposed to the 95% the Fed will buy through its Main Street New Loan Facility and Main Street Expanded Loan Facility, announced earlier this month." [Washington Business Journal, 04/30/20]

This New Priority Loan Program Now Allows Borrowers To "Refinance Existing Debt" They Owe To Any Lender. "The Eligible Borrower must commit to refrain from repaying the principal balance of, or paying any interest on, any debt until the Eligible Loan is repaid in full, unless the debt or interest payment is mandatory and due. However, the Eligible Borrower may, at the time of origination of the Eligible Loan, refinance existing debt owed by the Eligible Borrower to a lender that is not the Eligible Lender. The Eligible Borrower must commit that it will not seek to cancel or reduce any of its committed lines of credit with the Eligible Lender or any other lender." [Federal Reserve Main Street Priority Loan Facility, 04/30/20]

- While The Federal Reserve's New Loans And Expanded Loans Programs Still Do Not Allow Borrowers To Repay Any Existing Debt. "The Eligible Borrower must commit to refrain from repaying the principal balance of or paying any interest on, any debt until the upsized tranche of the Eligible Loan is repaid in full unless the debt or interest payment is mandatory and due. The Eligible Borrower must commit that it will not seek to cancel or reduce any of its committed lines of credit with the Eligible Lender or any other lender." [Federal Reserve Main Street Expanded Loan Facility, 04/30/20]

IPAA Maintains Very Close Ties To The Trump Administration And Was Even Caught Secretly Boasting About Their "Direct Access" To David Bernhardt, Trump's Secretary Of The Interior.

Interior Secretary David Bernhardt Used To Work For IPAA, And The IPAA CEO Said Of Bernhardt Being Of Interior, "That's Worked Out Well." "In that Ritz-Carlton conference room, [IPAA CEO Barry Russell] also spoke of his ties to Bernhardt, recalling the lawyer's role as point man on an [IPAA] legal team set up to challenge federal endangered species rules. 'Well, the guy that actually headed up that group is now the No. 2 at Interior,' he said, referring to Bernhardt. 'So that's worked out well.'" [Politico, 03/23/19]

IPAA's Political Director Bragged They Had "Direct Access" To Bernhardt In His Role In Trump's Administration, And Would Allow IPAA's Priorities To "Be Heard At The Highest Levels Of Interior." "Gathered for a private meeting at a beachside Ritz-Carlton in Southern California, the oil executives were celebrating a colleague's sudden rise. David Bernhardt, their former lawyer, had been appointed by President Donald Trump to the powerful No. 2 spot at the Department of the Interior. Just five months into the Trump era, the energy developers who make up the Independent Petroleum Association of America had already watched the new president order a sweeping overhaul of environmental regulations that were cutting into their bottom lines -- rules concerning smog, fracking and endangered species protection. Dan Naatz, the association's political director, told the conference room audience of about 100 executives that Bernhardt's new role meant their priorities would be heard at the highest levels of Interior. 'We know him very well, and we have direct access to him, have conversations with him about issues ranging from federal land access to endangered species, to a lot of issues,' Naatz said, according to an hourlong recording of the June 2017 event in Laguna Niguel provided to Reveal from The Center for Investigative Reporting." [Politico, 03/23/19]

Western Values Project brings accountability to the national conversation about Western public lands and national parks conservation - a space too often dominated by industry lobbyists and their allies in government.

LATEST NEWS

'Shame': Bill Including Warrantless Spying Expansion Passes Senate, Becomes Law

"The Make Everyone A Spy provision will be abused, and history will know who to blame," one civil liberties advocate said.

Apr 20, 2024

The U.S. Senate voted early Saturday morning to reauthorize Section 702 of the Foreign Intelligence Surveillance Act for two years, including a "poison bill" amendment added by the U.S. House that critics and privacy advocates dubbed the "Make Everyone a Spy" provision.

The reauthorization, officially called the Reforming Intelligence and Securing America Act, passed the Senate 60-34 despite the more than 20,000 constituents who called opposing the measure, which the Brennan Center for Justice said would enable "the largest expansion of surveillance on U.S. soil since the Patriot Act." President Joe Biden then signed the bill into law later Saturday.

"It's over (for now)," Elizabeth Goitein, the co-director of the Brennan Center's liberty and national security program, said on social media. "A majority of senators caved to the fearmongering and bush league tactics of the administration and surveillance hawks in Congress, and they sold out Americans' civil liberties."

"There is no defense for putting a tool this dangerous in the hands of any president, and doing so is a historic mark of shame."

Section 702 is the provision that allows U.S. intelligence agencies to spy on non-U.S. citizens abroad without a warrant. Currently, they are able to do so by acquiring communications data from electronic communications service providers like Google, Verizon, and AT&T. The existing provision has already been widely abused and criticized, as the communications of U.S. citizens are often caught up in the searches.

However, an amendment added by Reps. Mike Turner (R-Ohio) and Jim Himes (D-Conn.) redefined electronic communications service providers to include any "service provider who has access to equipment that is being or may be used to transmit or store wire or electronic communications."

Former and current U.S. officials toldThe Washington Post that the new language was intended to apply to data cloud storage centers, but civil liberties advocates like Goitein warn it could be used to compel any business—such as a grocery store, gym, or laundry service—to allow the National Security Agency (NSA) to scoop up data from its phones or computers.

"The provision effectively grants the NSA access to the communications equipment of almost any U.S. business, plus huge numbers of organizations and individuals," Goitein wrote on social media early Saturday. "It's a gift to any president who may wish to spy on political enemies, journalists, ideological opponents, etc."

"It is nothing short of mind-boggling that 58 senators voted to keep this Orwellian power in the bill," Goitein wrote.

Privacy advocates also criticized how the vote was forced through, as the Biden administration and Senate leaders including Senate Majority Leader Chuck Schumer (D-N.Y.) and Chairman of the Senate Select Committee on Intelligence Mark Warner (D-Va.) had emphasized that Section 702 was set to expire on Friday and raised alarms about what would happen to national security if the Senate allowed this to happen. However, as The New York Times pointed out, a national security court ruled this month that the program could run for another year even if the law expired.

"The headlines of state-aligned media screech and crow about the nefarious designs of your fellow citizens and the necessity of foreign wars without end, but find few words for a crime against the Constitution."

"Senator Warner and the administration rammed this poison pill through the Senate by fearmongering and saying things that are simply false," Demand Progress policy director Sean Vitka said in a statement. "There is no defense for putting a tool this dangerous in the hands of any president, and doing so is a historic mark of shame."

Once Biden had signed the bill, Vitka added on social media: "Shame on the leaders who let House Intelligence veto reform in the darkness, and ram through terrifying surveillance expansions on the basis of outright lies. The Make Everyone A Spy provision will be abused, and history will know who to blame."

Goitein used similar language to condemn the vote.

"This is a shameful moment in the history of the United States Congress," she said on social media. "It's a shameful moment for this administration, as well. But ultimately, it's the American people who pay the price for this sort of thing. And sooner or later, we will."

NSA whistleblower Edward Snowden added, "America lost something important today, and hardly anyone heard. The headlines of state-aligned media screech and crow about the nefarious designs of your fellow citizens and the necessity of foreign wars without end, but find few words for a crime against the Constitution."

Schumer announced a deal late Friday to vote on a series of amendments to the bill clearing the way toward its passage, according toTheHill. However, all five amendments that would have added greater privacy protections were voted down, The Washington Post reported.

"If the government wants to spy on the private comms of any American, they should be required to get approval from a judge, as the Founding Fathers intended."

These included an amendment from Sen. Richard Durbin (D-Ill.) to require a warrant and another from Sen. Ron Wyden (D-Ore.) to remove the House language expanding the entities who could be forced to spy, according to Roll Call. The amendments were rejected 42-50 and 34-58 respectively.

"Congress' intention when we passed FISA Section 702 was clear as could be—Section 702 is supposed to be used only for spying on foreigners abroad. Instead, sadly, it has enabled warrantless access to vast databases of Americans' private phone calls, text messages, and e-mails," Durbin posted on social media.

"I'm disappointed my narrow amendment to protect Americans while preserving Section 702 as a foreign intel tool wasn't agreed to," Durbin continued. "If the government wants to spy on the private comms of any American, they should be required to get approval from a judge, as the Founding Fathers intended."

Wyden said in a statement: "The Senate waited until the 11th hour to ram through renewal of warrantless surveillance in the dead of night. But I'm not giving up. The American people know that reform is possible and that they don't need to sacrifice their liberty to have security. It is clear from the votes on very popular amendments that senators were unwilling to send this bill back to the House, no matter how common-sense the amendment before them."

Wyden was not the only one who pledged to keep fighting government surveillance overreach.

Vitka praised Durbin and Wyden, as well as other legislative privacy advocates including Sens. Rand Paul (R-Ky.) and Mike Lee (R-Utah) and Reps. Pramila Jayapal (D-Wash.), Warren Davidson (R-Ohio), Zoe Lofgren (D-Calif.), Andy Biggs (R-Ariz.), Jerrold Nadler (D-N.Y.), and Jim Jordan (R-Ohio), saying the lawmakers had "built a formidable foundation from which we will all continue to fight for civil liberties."

Goitein also said the opposition of outspoken senators and concerned citizens were "silver linings."

"Because of the heat we were able to bring, we extracted some promises from the administration and the Senate intelligence committee chair. I do think they'll be forced to make SOME changes to mitigate the worst parts of the law, which they can do by including those changes in an upcoming must-pass vehicle, like the National Defense Authorization Act," she added.

The American Civil Liberties Union also responded to the vote on social media.

"Senators were aware of the threat this surveillance bill posed to our civil liberties and pushed it through anyway, promising they would attempt to address some of the most heinous expansions in the near future," the organization said. "We will do everything in our power to ensure these promises are kept."

Keep ReadingShow Less

'You All Moved a Mountain': Tennessee Volkswagen Workers Vote to Join UAW

"We're poised to be the first domino of many to fall," one worker at the Chattanooga plant said.

Apr 20, 2024

Workers at a Volkswagen plant in Chattanooga, Tennessee, became the first Southern autoworkers not employed by one of the Big Three car manufacturers to win a union Friday night when they voted to join the United Auto Workers by a "landslide" majority.

This is the first major victory for the UAW after it launched the biggest organizing drive in modern U.S. history on the heels of its "stand up strike" that secured historic contracts with the Big Three in fall 2023.

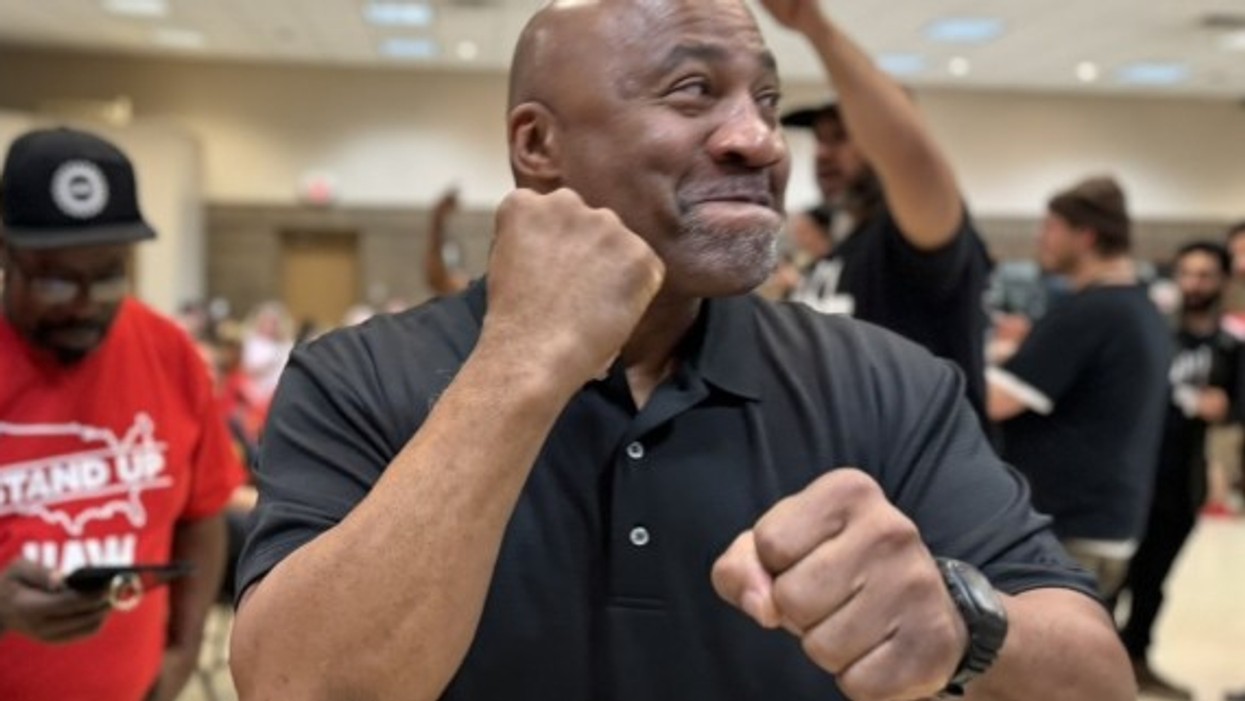

"Many of the talking heads and the pundits have said to me repeatedly before we announced this campaign, 'You can't win in the South,'" UAW president Shawn Fain told the victorious workers in a video shared by UAW. "They said Southern workers aren't ready for it. They said non-union autoworkers didn't have it in them. But you all said, 'Watch this!' And you all moved a mountain."

"This incredible victory for labor will transform Tennessee and the South!"

According to the UAW's real-time results, the vote tally now stands at 2,628—or 73%—yes to 985—or 27%—no. Voting at the around 4,300-worker plant began Wednesday.

The Chattanooga workers announced their current union drive in December 2023. Friday's victory follows two failed unionization attempts at the plant in 2014 and 2019.

"We saw the big contract that UAW workers won at the Big Three and that got everybody talking," Zachary Costello, a trainer in VW's proficiency room, said in a statement. "You see the pay, the benefits, the rights UAW members have on the job, and you see how that would change your life. That's why we voted overwhelmingly for the union. Once people see the difference a union makes, there's no way to stop them."

The union's win comes despite the opposition of Republican Tennessee Gov. Bill Lee.

"Today, I joined fellow governors in opposing the UAW's unionization campaign," Lee said on social media Tuesday. "We want to keep good-paying jobs and continue to grow the American auto manufacturing sector. A successful unionization drive will stop this growth in its tracks, to the detriment of American workers."

However, Tennessee State Rep. Justin Jones (D-52) celebrated the win.

"Watching history tonight in Chattanooga, as Volkswagen workers voted in a landslide to join the UAW," he wrote on social media Friday night. "Despite pressure from Gov. Lee, this is the first auto plant in the South to unionize since the 1940s. This incredible victory for labor will transform Tennessee and the South!"

Other national labor leaders and progressive politicians also congratulated the Chattanooga workers.

Lee Saunders, president of the American Federation of State, County, and Municipal Employees, said the win "shows what we already know—workers in every part of this country want the freedom to join a union, and when we stand together, we have tremendous power. Even though the deck is stacked against us, momentum is on our side, and we're winning."

Sen. Bernie Sanders (I-Vt.) said: "This is a huge victory not only for UAW workers at Volkswagen, but for every worker in America. The tide is turning. Workers all across the country, even in our most conservative states, are sick and tired of corporate greed and are demanding economic justice."

"I think it's a great push for the entire South, and people will follow suit."

Rep. Alexandria Ocasio-Cortez (D-N.Y.) called the results "an utterly historic victory for the working class."

"Tennessee is shining bright tonight," she wrote on social media Friday. "We are in a new era. Congratulations to the courageous workers in Chattanooga and the entire UAW. Absolutely heroic. Solidarity IS the strategy—across the South, and all over the country."

More Perfect Union said the victory would "change the auto industry, and the future of American labor," and the campaign organizers themselves are aware of the importance of what they've accomplished.

"We understand that the world's watching us," worker Isaac Meadows, who has been at the plant for one year, told More Perfect Union. "You know there's a labor movement in this country, you know, we're poised to be the first domino of many to fall."

Worker Kelcey Smith, who has also been at the plant for one year, added, "I think it's a great push for the entire South, and people will follow suit."

The next domino to fall could be the Mercedes-Benz plant in Vance, Alabama, where a UAW election is scheduled from May 13-17. All told, more than 10,000 non-union car makers have signed union cards since the UAW launched its historic organizing drive.

For the Chattanooga workers, meanwhile, their next big fight will be to secure their first union-negotiated contract.

"The real fight begins now," Fain told cheering workers. "The real fight is getting your fair share. The real fight is the fight to get more time with your families. The real fight is the fight for our union contract."

"And I can guarantee you one thing," Fain continued, "this international unionist leadership, this membership all over this nation has your back in this fight."

Keep ReadingShow Less

Sanders, Booker, and Welch Unveil Ban on Junk Food Ads Targeting Kids

"We cannot continue to allow large corporations in the food and beverage industry to put their profits over the health and wellbeing of our children," said Sen. Bernie Sanders.

Apr 19, 2024

A trio of U.S. senators on Friday introduced what's being billed as first-of-its-kind legislation sponsors say will "take on the greed of the food and beverage industry and address the growing diabetes and obesity epidemics" with a federal ban on junk food ads targeting children.

The Childhood Diabetes Reduction Act—introduced by Sens. Bernie Sanders (I-Vt.), Cory Booker (D-N.J.), and Peter Welch (D-Vt.)—would also require warning labels "on sugar-sweetened foods and beverages; foods and beverages containing non-sugar sweeteners; ultra-processed foods; and foods high in nutrients of concern, such as added sugar, saturated fat, or sodium."

"Let's be clear: The twin crises of type 2 diabetes and obesity in America are being fueled by the food and beverage industry that, for decades, has been making massive profits by enticing children to consume unhealthy products purposely designed to be overeaten," Sanders—who chairs the Senate Health, Education, Labor, and Pensions (HELP) Committee—said in a statement. "We cannot continue to allow large corporations in the food and beverage industry to put their profits over the health and wellbeing of our children."

"Nearly 30 years ago, Congress had the courage to take on the tobacco industry, whose products killed more than 400,000 Americans every year," Sanders added. "Now is the time for Congress to act with the same sense of urgency to combat these diabetes and obesity epidemics. That means banning junk food ads targeted to kids and putting strong warning labels on food and beverages with unacceptably high levels of sugar, salt, and saturated fat."

Booker said that "the future of our nation depends on a continued investment in the health and wellbeing of our children," adding that "more and more of our children are developing diabetes and obesity primarily because a handful of corporate food giants push addictive, ultra-processed foods to drive up their profits."

"By banning junk food advertising to children, implementing front-of-package warning labels, and funding research on the dangers of ultra-processed foods, we can rein in the predatory behavior of big food companies and ensure a healthier future for generations to come," he added.

As the senators noted:

Today, more than 35 million Americans are struggling with type 2 diabetes—90% of whom are overweight or obese. These crises go hand-in-hand and children are severely impacted. Today, 1 out of 5 five kids are living with obesity. A serious illness unto itself, diabetes is also a contributing factor to heart disease, stroke, amputations, blindness, and kidney failure. Unless the U.S. dramatically changes course, these numbers will continue to grow exponentially.

The impact on the economy is enormous: Last year, the total cost of diabetes exceeded $400 billion, approximately 10% of overall U.S. healthcare expenditures.

Meanwhile, the U.S. food and beverage industry spends about $14 billion annually on marketing unhealthy products, with $2 billion of that spent on advertising these products to children.

"Our food environment has become dominated by ultra-processed foods that have more in common with a cigarette than a fruit or vegetable," said Ashley Gearhardt, director of the Food and Addiction Science & Treatment Lab at the University of Michigan. "Many ultra-processed foods are hyperpalatable and trigger the core signs of addiction, like intense cravings and a loss of control over intake."

"The American public is not adequately warned about the risks associated with these products and children are a key marketing demographic for ultra-processed foods with unhealthy nutrient profiles," Gearhardt added. "The Childhood Diabetes Reduction Act is a courageous step towards promoting the physical and mental health of American children."

Keep ReadingShow Less

Most Popular