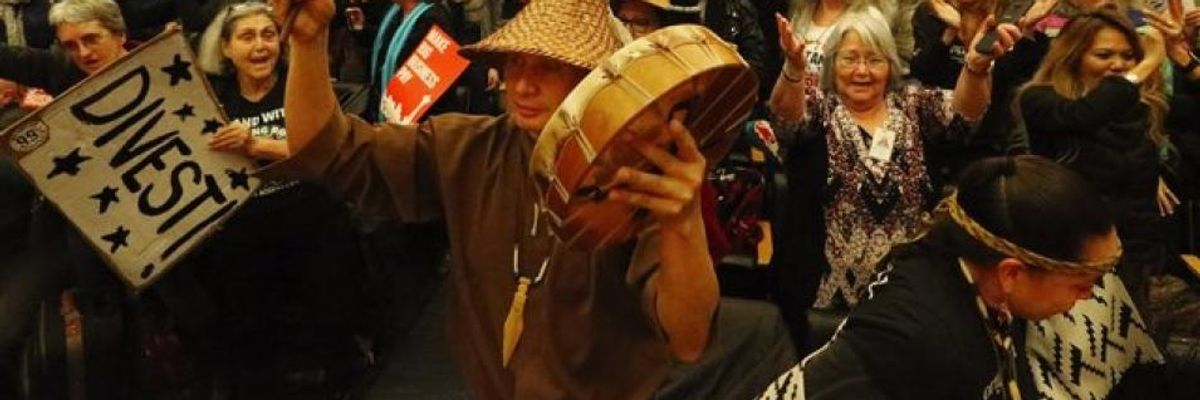

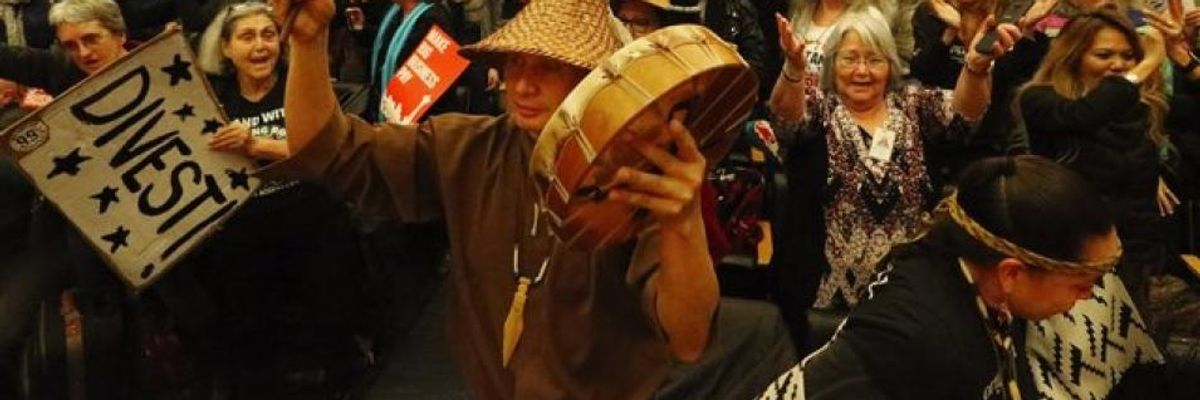

A packed Seattle City Council chamber cheers passage of the bill to drop Wells Fargo as its bank last week. (Photo: Ken Lambert / The Seattle Times)

To donate by check, phone, or other method, see our More Ways to Give page.

A packed Seattle City Council chamber cheers passage of the bill to drop Wells Fargo as its bank last week. (Photo: Ken Lambert / The Seattle Times)

The final link of the Dakota Access Pipeline (DAPL) can now be built, thanks to a recent decision by the Army Corps of Engineers (although the Cheyenne River Sioux have filed a last-minute suit to stop it). In light of the disappointing but unsurprising federal approval of the pipeline, it is worth pausing to ask who and what DAPL is good for.

Who needs the pipeline? There are four main answers: three are silly and one is dangerous.

Silly answer #1 is that the ravenous ego in the White House needs a continual flow of evidence that he is always a winner and his enemies are all losers. Indian tribes and environmentalists can get in line next to Muslims and Mexicans as obstacles, which he shall overcome, to the huge success of making America some kind of great again.

Answer #2, only slightly less silly, is that Energy Transfer Partners (ETP), the company that built the pipeline, has $3.8 billion invested and won't earn a dime on it unless the pipeline is finished. ETP is a well-connected company - at least until recently, Rick Perry was on its board of directors and Donald Trump was one of its stockholders. Surely that's irrelevant to the recent decision.

But it is well established in economic theory that people who make bad investments should lose money on them. Milton Friedman, the forefather of conservative free-market economics, was emphatic on this point. As Friedman might have asked, why is DAPL a worthwhile investment that deserves to make money? Who actually needs this pipeline?

Answer #3 is only silly if you pay attention to the numbers. Building a pipeline creates jobs. Good, high-paying jobs making and laying pipe. In fact, building anything creates jobs. Building a bridge to nowhere or a pipeline that no one needs will create jobs - but building things that people need can create even more jobs. An in-depth study of alternatives to the proposed Keystone XL pipeline found that the host states could gain many more jobs by investing in much-needed infrastructure for clean water and natural gas distribution.

Moreover, almost all the jobs created by building DAPL have already happened, because the pipeline is almost complete. It makes no sense to count past jobs as future benefits. If construction jobs are an important benefit of the pipeline, I hope you enjoyed them; they're all but over. Once a pipeline is completed and in operation, it needs very few workers to keep it going.

Finally, the dangerous answer is that DAPL would be useful to keep oil flowing if the price of oil was much higher than it is today. The danger involves the factors that might cause higher prices. But first, a little back story.

DAPL was planned in early 2014, at a time when the price of oil had been above $80 per barrel, often closer to $100, for the past several years. Oil production in North Dakota was booming, and there were early signs of a shortage of pipeline and rail capacity to carry the state's oil.

Then, in the second half of 2014, the price of oil collapsed. Since the beginning of 2015, the price of oil has been below $60 per barrel, occasionally far below. Oil production in North Dakota has slumped, and the volume of oil carried out of the state by pipeline or rail transport has plunged so low that there is no hint of a capacity shortage.

North Dakota is among the most expensive on-shore locations for oil production in North America. Several oil experts have estimated that the break-even price for North Dakota oil is $60 per barrel or more. In my own study of the state's data, I found that North Dakota oil production tends to go up when the price has averaged more than $61.50 per barrel for the last few months. The flip side is that North Dakota output tends to drop when the price of oil lingers below $61.50 - as it has done for the last two years, ever since early 2015.

So DAPL will only be needed for oil transport if the price of oil goes, and stays, much higher than it is today. Here comes the dangerous part: suppose that an out-of-control White House was inflaming conflict in the Middle East, threatening bad relations or even war with major oil producing nations. If OPEC countries cut off oil shipments to the United States, the price of oil will soar, North Dakota's oil boom will resume, and DAPL will become key to Fortress America's oil supplies.

Normal diplomacy would prevent that, of course. But normal diplomacy is so 2016.

Common Dreams is powered by optimists who believe in the power of informed and engaged citizens to ignite and enact change to make the world a better place. We're hundreds of thousands strong, but every single supporter makes the difference. Your contribution supports this bold media model—free, independent, and dedicated to reporting the facts every day. Stand with us in the fight for economic equality, social justice, human rights, and a more sustainable future. As a people-powered nonprofit news outlet, we cover the issues the corporate media never will. Join with us today! |

The final link of the Dakota Access Pipeline (DAPL) can now be built, thanks to a recent decision by the Army Corps of Engineers (although the Cheyenne River Sioux have filed a last-minute suit to stop it). In light of the disappointing but unsurprising federal approval of the pipeline, it is worth pausing to ask who and what DAPL is good for.

Who needs the pipeline? There are four main answers: three are silly and one is dangerous.

Silly answer #1 is that the ravenous ego in the White House needs a continual flow of evidence that he is always a winner and his enemies are all losers. Indian tribes and environmentalists can get in line next to Muslims and Mexicans as obstacles, which he shall overcome, to the huge success of making America some kind of great again.

Answer #2, only slightly less silly, is that Energy Transfer Partners (ETP), the company that built the pipeline, has $3.8 billion invested and won't earn a dime on it unless the pipeline is finished. ETP is a well-connected company - at least until recently, Rick Perry was on its board of directors and Donald Trump was one of its stockholders. Surely that's irrelevant to the recent decision.

But it is well established in economic theory that people who make bad investments should lose money on them. Milton Friedman, the forefather of conservative free-market economics, was emphatic on this point. As Friedman might have asked, why is DAPL a worthwhile investment that deserves to make money? Who actually needs this pipeline?

Answer #3 is only silly if you pay attention to the numbers. Building a pipeline creates jobs. Good, high-paying jobs making and laying pipe. In fact, building anything creates jobs. Building a bridge to nowhere or a pipeline that no one needs will create jobs - but building things that people need can create even more jobs. An in-depth study of alternatives to the proposed Keystone XL pipeline found that the host states could gain many more jobs by investing in much-needed infrastructure for clean water and natural gas distribution.

Moreover, almost all the jobs created by building DAPL have already happened, because the pipeline is almost complete. It makes no sense to count past jobs as future benefits. If construction jobs are an important benefit of the pipeline, I hope you enjoyed them; they're all but over. Once a pipeline is completed and in operation, it needs very few workers to keep it going.

Finally, the dangerous answer is that DAPL would be useful to keep oil flowing if the price of oil was much higher than it is today. The danger involves the factors that might cause higher prices. But first, a little back story.

DAPL was planned in early 2014, at a time when the price of oil had been above $80 per barrel, often closer to $100, for the past several years. Oil production in North Dakota was booming, and there were early signs of a shortage of pipeline and rail capacity to carry the state's oil.

Then, in the second half of 2014, the price of oil collapsed. Since the beginning of 2015, the price of oil has been below $60 per barrel, occasionally far below. Oil production in North Dakota has slumped, and the volume of oil carried out of the state by pipeline or rail transport has plunged so low that there is no hint of a capacity shortage.

North Dakota is among the most expensive on-shore locations for oil production in North America. Several oil experts have estimated that the break-even price for North Dakota oil is $60 per barrel or more. In my own study of the state's data, I found that North Dakota oil production tends to go up when the price has averaged more than $61.50 per barrel for the last few months. The flip side is that North Dakota output tends to drop when the price of oil lingers below $61.50 - as it has done for the last two years, ever since early 2015.

So DAPL will only be needed for oil transport if the price of oil goes, and stays, much higher than it is today. Here comes the dangerous part: suppose that an out-of-control White House was inflaming conflict in the Middle East, threatening bad relations or even war with major oil producing nations. If OPEC countries cut off oil shipments to the United States, the price of oil will soar, North Dakota's oil boom will resume, and DAPL will become key to Fortress America's oil supplies.

Normal diplomacy would prevent that, of course. But normal diplomacy is so 2016.

The final link of the Dakota Access Pipeline (DAPL) can now be built, thanks to a recent decision by the Army Corps of Engineers (although the Cheyenne River Sioux have filed a last-minute suit to stop it). In light of the disappointing but unsurprising federal approval of the pipeline, it is worth pausing to ask who and what DAPL is good for.

Who needs the pipeline? There are four main answers: three are silly and one is dangerous.

Silly answer #1 is that the ravenous ego in the White House needs a continual flow of evidence that he is always a winner and his enemies are all losers. Indian tribes and environmentalists can get in line next to Muslims and Mexicans as obstacles, which he shall overcome, to the huge success of making America some kind of great again.

Answer #2, only slightly less silly, is that Energy Transfer Partners (ETP), the company that built the pipeline, has $3.8 billion invested and won't earn a dime on it unless the pipeline is finished. ETP is a well-connected company - at least until recently, Rick Perry was on its board of directors and Donald Trump was one of its stockholders. Surely that's irrelevant to the recent decision.

But it is well established in economic theory that people who make bad investments should lose money on them. Milton Friedman, the forefather of conservative free-market economics, was emphatic on this point. As Friedman might have asked, why is DAPL a worthwhile investment that deserves to make money? Who actually needs this pipeline?

Answer #3 is only silly if you pay attention to the numbers. Building a pipeline creates jobs. Good, high-paying jobs making and laying pipe. In fact, building anything creates jobs. Building a bridge to nowhere or a pipeline that no one needs will create jobs - but building things that people need can create even more jobs. An in-depth study of alternatives to the proposed Keystone XL pipeline found that the host states could gain many more jobs by investing in much-needed infrastructure for clean water and natural gas distribution.

Moreover, almost all the jobs created by building DAPL have already happened, because the pipeline is almost complete. It makes no sense to count past jobs as future benefits. If construction jobs are an important benefit of the pipeline, I hope you enjoyed them; they're all but over. Once a pipeline is completed and in operation, it needs very few workers to keep it going.

Finally, the dangerous answer is that DAPL would be useful to keep oil flowing if the price of oil was much higher than it is today. The danger involves the factors that might cause higher prices. But first, a little back story.

DAPL was planned in early 2014, at a time when the price of oil had been above $80 per barrel, often closer to $100, for the past several years. Oil production in North Dakota was booming, and there were early signs of a shortage of pipeline and rail capacity to carry the state's oil.

Then, in the second half of 2014, the price of oil collapsed. Since the beginning of 2015, the price of oil has been below $60 per barrel, occasionally far below. Oil production in North Dakota has slumped, and the volume of oil carried out of the state by pipeline or rail transport has plunged so low that there is no hint of a capacity shortage.

North Dakota is among the most expensive on-shore locations for oil production in North America. Several oil experts have estimated that the break-even price for North Dakota oil is $60 per barrel or more. In my own study of the state's data, I found that North Dakota oil production tends to go up when the price has averaged more than $61.50 per barrel for the last few months. The flip side is that North Dakota output tends to drop when the price of oil lingers below $61.50 - as it has done for the last two years, ever since early 2015.

So DAPL will only be needed for oil transport if the price of oil goes, and stays, much higher than it is today. Here comes the dangerous part: suppose that an out-of-control White House was inflaming conflict in the Middle East, threatening bad relations or even war with major oil producing nations. If OPEC countries cut off oil shipments to the United States, the price of oil will soar, North Dakota's oil boom will resume, and DAPL will become key to Fortress America's oil supplies.

Normal diplomacy would prevent that, of course. But normal diplomacy is so 2016.