The enduring mystery about President George W. Bush's old plan to privatize Social Security by moving contributions into individual savings accounts is how it survived two market crashes and decades of underperformance by workers' 401(k) accounts.

This isn't a game-show fantasy....Whoever earns at least the minimum wage can become a millionaire in 45 years.

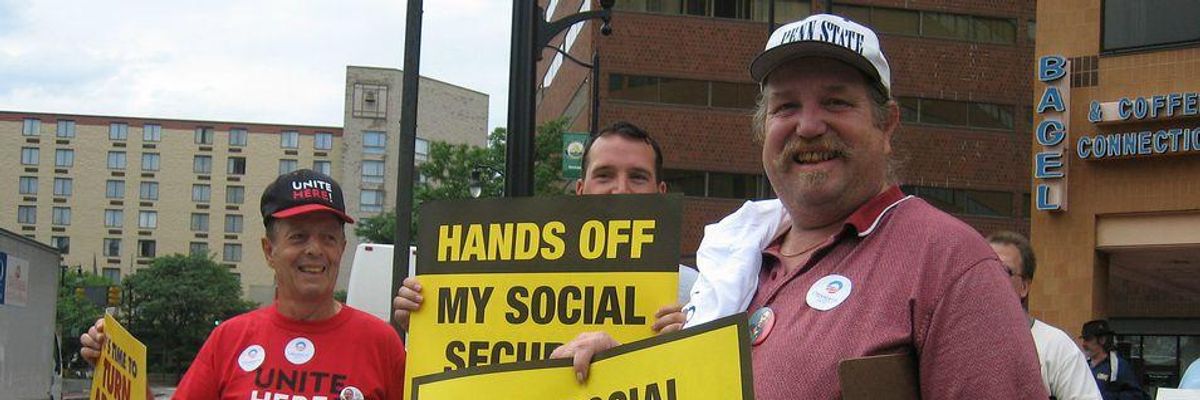

- Social Security privatization guru Sam Beard, during the stock market boom of the 1990s.Yet this idea still walks among us, like a zombie. As Bryce Covert of ThinkProgress observed Monday, it's been hawked by several of today's aspirants to the Republican nomination for President, including George W.'s brother Jeb, Sen. Ted Cruz (R-Tex.), Sen. Rand Paul, (R-Ky.), and Mike Huckabee and Rick Perry.

One would think no one needs more evidence to understand why privatizing Social Security is a terrible idea and well-nigh unworkable, but the recent convulsions in the stock market provide the opportunity for a refresher.

We pointed out earlier Monday that one day's market action--or even a week's--doesn't tell us much about the long-term direction of stocks, but that's true chiefly for investors in it for the long term. Retirees and near-retirees don't always have the luxury of a distant horizon. For someone planning to retire in the next month or year, the recent pullback of 10% can have direct and serious consequences.

The privatization idea was born during the go-go years of the 1980s and '90s, when everyone seemed to think that the bull market would go on forever. Individual workers, it was argued, could do a lot better over a 45-year working career by putting some or all of their 12.4% payroll tax into the stock market (counting their and their employers' contributions together) than the stodgy old Social Security Administration did by investing its surplus in Treasury bonds, its only legal investment. "This isn't a game-show fantasy," gushed Sam Beard, a leading promoter of Bush's privatization plan beginning in 2001. "Whoever earns at least the minimum wage can become a millionaire in 45 years."

This overlooked a few uncomfortable facts. One was that there was risk embedded in stocks' superior returns over bonds--and that risk was not evenly distributed. Privatization gurus noted that over the long run, stocks produced an annualized return of about 8%, which made them a great investment for anyone with a 45-year time horizon.

Continue reading here.