October, 17 2016, 09:15am EDT

New Yorkers Issue New Challenge to Divest City & State Pensions from Fossil Fuels

Ahead of the four-year anniversary of Sandy and the Paris climate agreement taking effect, broad spectrum of New York society calls for divestment and reinvestment in solutions

NEW YORK

After a summer of record heat, ahead of the fourth anniversary of Superstorm Sandy and weeks before the Paris climate agreement officially comes into effect, New Yorkers are issuing a new challenge to New York City Comptroller Scott Stringer and New York State Comptroller Tom DiNapoli to divest New York's combined $350 billion pension funds from fossil fuels and reinvest in climate solutions.

Eighteen organizations and individuals, representing a broad spectrum of New York society, including business, faith, academics, health, students, artists, and more, sent a letter to the comptrollers calling for the pension funds to use every tool at their disposal to curb the worst of climate impacts, and avoid the next Sandy-like storm, through divestment from fossil fuels.

The initial call for the State and City to divest launched in 2012, the same year that Superstorm Sandy devastated communities. Since then, more than 600 institutions and individuals representing over $3.4 trillion in assets have committed to some level of divestment, but the New York funds have yet to take action.

With the moral and financial reasons to divest adding up, the push may now be reaching a boiling point. Last year, Comptroller Stringer and Mayor Bill de Blasio publicly expressed support for divestment from coal. Additionally, New York City Councilwoman Helen Rosenthal and Councilman Costa Constantinides have called for divestment. One of New York City's pension funds has started the process of exploring coal divestment.

The reticence has been costly. A March report revealed that the New York State Common Retirement Fund, the third largest pension fund in the country, lost a staggering $5.3 billion from holding onto its fossil fuel investments. New York City's largest pension fund, the Teacher's Retirement System of the City of New York, lost approximately $135 million from its fossil fuel holdings in only one year.

Last Saturday, New York City's largest public employee union, District Council 37, held a forum exploring how divestment could promote clean energy and environmental justice. On October 28, New York State Senator Liz Krueger, Senator Brad Hoylman and Assemblyman Felix Ortiz, who introduced state legislation to divest the state pension fund, will co-sponsor a roundtable featuring a panel of financial experts and representatives from the state comptroller's office.

The barrier to progress at the state level has been Comptroller DiNapoli, who has repeatedly argued against divestment, claiming that it is more effective to participate in shareholder engagement. That case is falling apart, however, as fossil fuel companies repeatedly ignore or vote down the fund's requests. At Exxon's shareholder meeting this past May, for example, New York State and the Church of England proposed a resolution that called for disclosure of basic climate impact reporting. Despite the resolution being non-binding, Exxon's executives unanimously shot it down, resulting in ultimate rejection.

The case of Exxon is particularly egregious. Investigative reports revealed that, as far back as the 1970s, Exxon's own scientists confirmed the impact of fossil fuel use on the climate, but executives instead chose to orchestrate a decades-long campaign of deception. Now, Exxon is under investigation by New York's own attorney general Eric Schneiderman, the attorneys general of Massachusetts and California, and the Securities and Exchange Commission, for potential fraud concerning climate change.

As governments get serious about climate action, the pressure to divest will only grow. Earlier this month, the required number of countries ratified the Paris climate agreement to enter it into force, and it will officially take effect on November 4. Stringer and DiNapoli both traveled to the Paris climate talks last December and have repeatedly called for action on climate. Their lack of action on divestment, however, has undermined attempts to don the mantle of climate leadership.

Notable divestment commitments in the US include Washington, DC's largest pension fund, the Rockefeller Brothers Fund, California's CalPERS and CalSTRS, the New School in New York City, New York's Union Theological Seminary, and the union-owned Amalgamated Bank.

QUOTE SHEET:

May Boeve, Executive Director of 350.org said, "Investments in the fossil fuel industry fund devastating climate impacts like Superstorm Sandy. Now, New Yorkers are coming together to push our comptrollers to take decisive action on climate and fully divest from this destruction. This challenge sends a clear message: it's past time for New York's comptrollers to stop propping up the fossil fuel industry, and reinvest in an economy that prioritizes people and planet."

Mark Dunlea, chair of the state divestment committee for 350NYC said, "It is wrong for NY to invest our pension funds in fossil fuel companies which threaten the quality of life for our residents. Decades of shareholder advocacy have proven ineffective to curb corporate misbehavior. We need Stringer and DiNapoli to step up and provide the leadership needed to position New York as a world leader in confronting climate change."

David Levine, Co-founder and CEO of the American Sustainable Business Council, which has a membership representing over 250,000 business owners, executives and investors across the country said, "The financial risks are too great to continue subsidizing and investing in fossil fuels. The economic data is proving instead the value of investing in the incredible growth in energy efficiency and renewable energy. The smart money is now on a future based on safe, renewable energy."

Vanessa Green, Director of Divest-Invest Individual, said "Millions of public employees nationwide stand waiting for pension decision makers to protect their hard-earned savings from climate risk. Inaction or delayed action makes public servants pay three times: once via bad investments in companies deepening the climate problem, twice via exposure to the life-threatening harm of extreme weather events like Hurricane Sandy, and thrice via potential retirement fund losses. New York's comptrollers must be facilitators of, not barriers to, a safe and reliable future for the working backbone of their city and state."

Greta Neubauer, Director of the Fossil Fuel Divestment Student Network, said "New Yorkers, especially low income people and communities of color, have and will continue to feel the impacts of climate change very personally. As the generation who will watch this city sink if we do not take action, we refuse to sit idly by. Our city and state officials cannot continue siding with the industry responsible for this crisis, we need them to side with us."

The Rev. Fletcher Harper, Executive Director of GreenFaith said, "Our lives on this earth are a gift, and it's not right for us to profit from an industry whose core business is devastating to the climate and to life itself. The time to divest is yesterday. It cannot happen too soon."

Rebecca Foon and Jesse Paris Smith, Co-founders of Pathway to Paris said, "In order to avoid catastrophic climate change, significant shifts need to be made as we speak towards a renewable future. New York City and New York State have an immense opportunity to help lead this path towards a future that is no longer dependant on fossil fuels, while stimulating the green economy by divesting its pension funds from fossil fuel companies and investing in climate solutions. The time is now."

350 is building a future that's just, prosperous, equitable and safe from the effects of the climate crisis. We're an international movement of ordinary people working to end the age of fossil fuels and build a world of community-led renewable energy for all.

LATEST NEWS

'Call Your Senator Now': Privacy Advocates Ramp Up Effort to Stop Spying Expansion

"Make no mistake," said one expert, "the day will come when there is a president in the White House who will not hesitate to make full use of the Orwellian power this bill provides."

Apr 16, 2024

With the U.S. Senate poised to vote later this week on legislation to reauthorize a heavily abused warrantless surveillance authority, privacy advocates are ramping up pressure on lawmakers to remove a provision that would force a wide range of businesses and individuals to take part in government spying operations.

Dubbed the "Make Everyone a Spy" provision by one advocacy group, the language was tucked into a House-passed bill that would extend Section 702 of the Foreign Intelligence Surveillance Act (FISA), which allows U.S. agencies to spy on non-citizens located outside of the country without a warrant. Americans' communications have frequently been collected under the spying authority.

The provision that has sparked grave warnings from privacy advocates was spearheaded by the chair of the House Permanent Select Committee on Intelligence, Rep. Mike Turner (R-Ohio), and the panel's ranking member, Rep. Jim Himes (D-Conn.).

While supporters of the provision, including the Biden White House, claim the proposed change to existing law is narrow, civil liberties defenders say it's anything but.

Currently, U.S. agencies can use Section 702 authority to collect the data of non-citizens abroad from electronic communications service providers such as Google, Verizon, and AT&T without a warrant.

The Turner-Himes amendment would significantly expand who could be ordered to cooperate with government surveillance efforts, broadening Section 702 language to encompass "any other service provider who has access to equipment that is being or may be used" to transmit or store electronic communications.

That change, privacy advocates say, would mean grocery stores, laundromats, gyms, barber shops, and other businesses would potentially be conscripted to serve as government spies.

"The Make Everyone a Spy provision is recklessly broad and a threat to democracy itself," Sean Vitka, policy director of Demand Progress, said in a statement Tuesday. "It is simply stunning that the administration and House Intelligence Committee do not have a single answer for how frighteningly broad this provision is."

"You can't create a surveillance state and just hope the government won't take advantage."

The New York Timesexplained Tuesday that after the FISA Court "approves the government's annual requests seeking to renew the program and setting rules for it, the administration sends directives to 'electronic communications service providers' that require them to participate."

In 2022, the Times noted, the FISA Court "sided with an unidentified company that had objected to being compelled to participate in the program because it believed one of its services did not fit the necessary criteria." Unnamed people familiar with the matter told the newspaper that "the judges found that a data center service does not fit the legal definition of an 'electronic communications service provider'"—prompting the bipartisan effort to expand the reach of Section 702.

"While the Department of Justice wants us to believe that this is simply about addressing data centers, that is no justification for exposing cleaning crews, security guards, and untold scores of other Americans to secret Section 702 directives, which are issued without any court review," Vitka said Tuesday. "Receiving one can be a life-changing event, and Jim Himes appears not to have any sense of that. The Senate must stop this provision from advancing."

Elizabeth Goitein, co-director of the Liberty and National Security Program at the Brennan Center for Justice, wrote on social media Tuesday that "it's critical to stop this bill."

"The administration claims it has no intent to use this provision so broadly—and who knows, maybe it doesn't. But the plain language of the bill allows involuntary conscription of much of the private sector for [National Security Agency] surveillance purposes," Goitein wrote. "Make no mistake, the day will come when there is a president in the White House who will not hesitate to make full use of the Orwellian power this bill provides. You can't create a surveillance state and just hope the government won't take advantage."

URGENT: Please read thread below. We have just days to convince the Senate NOT to pass a “terrifying” law (@RonWyden) that will force U.S. businesses to serve as NSA spies. CALL YOUR SENATOR NOW using this call tool (click below or call 202-899-8938). 1/25 https://t.co/HAOHURZoJQ

— Elizabeth Goitein (@LizaGoitein) April 15, 2024

With Section 702 set to expire Friday, Senate Majority Leader Chuck Schumer (D-N.Y.) said in a floor speech Tuesday that he has placed the House-passed FISA legislation on the chamber's calendar and will soon "file cloture on the motion to proceed" to the bill, which is titled the Reforming Intelligence and Securing America Act (RISAA).

"We don't have much time to act," said Schumer. "Democrats and Republicans are going to have to work together to meet the April 19th deadline. If we don't cooperate, FISA will expire, so we must be ready to cooperate."

Sen. Ron Wyden (D-Ore.), a member of the Senate Select Committee on Intelligence and outspoken privacy advocate, has called RISAA's proposed expansion of government surveillance "terrifying" and warned it would "force any American who installs, maintains, or repairs anything that transmits or stores communications to spy on the government's behalf."

According to the Times, Wyden's office has in recent days been circulating "a warning that the provision could be used to conscript someone with access to a journalist's laptop to extract communications between that journalist and a hypothetical foreign source who was targeted for intelligence."

In a social media post on Tuesday, Wyden echoed campaigners in urging people to contact their senators.

"Congress wants to make it easier for the government to spy on you without a warrant," Wyden wrote. "Scared? Me too. Call your senator at (202) 224-3121 before April 19 and tell them to vote NO on expanding warrantless government surveillance under FISA."

Keep ReadingShow Less

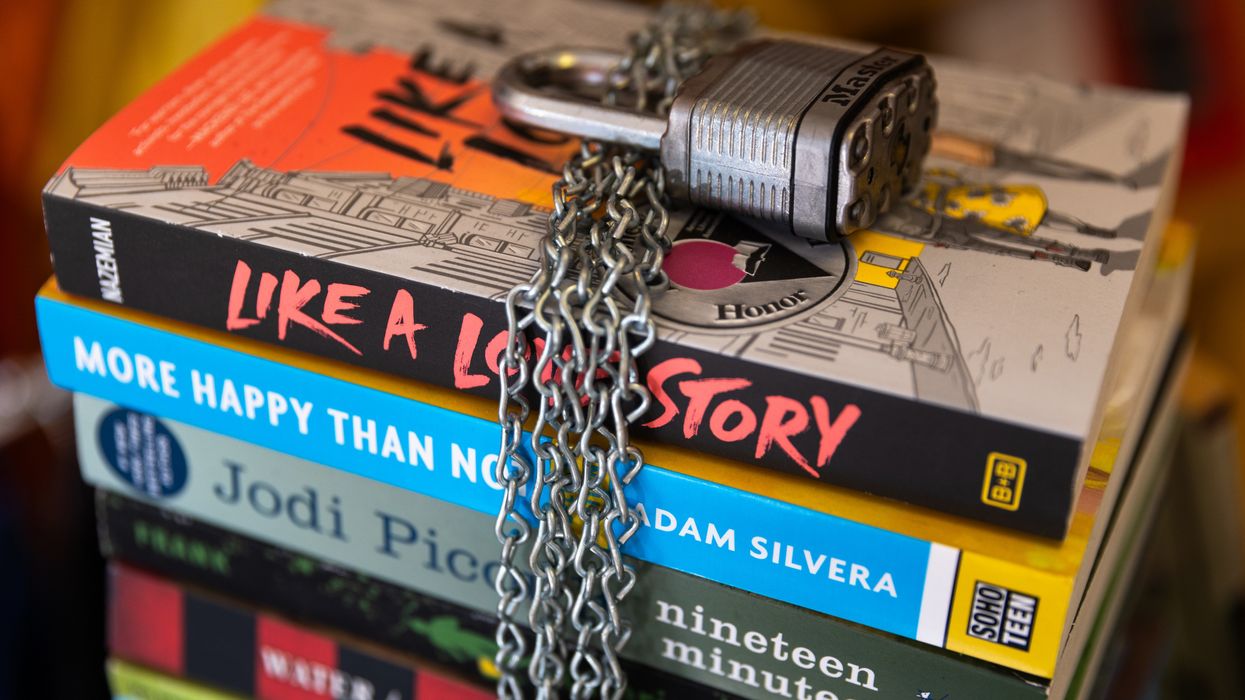

'Ed Scare' Deepens as 4,000+ Book Banned in First Half of School Year

"The bans we're seeing are broad, harsh, and pernicious—and they're undermining the education of millions of students across the country," said one lead author of a new PEN America report.

Apr 16, 2024

U.S. school districts banned more books during the first half of the current academic year than during the entire last scholastic year, a report published Tuesday revealed.

PEN America recorded 4,349 book bans across 52 school districts in 23 states during the fall 2023 semester, more than double the 1,841 titles that were prohibited during the spring term and more than the 3,362 volumes reported banned nationwide during the entire previous academic year.

"For anyone who cares about the bedrock of American values and the protection of free expression, this report should be a red alert," said Sabrina Baêta, manager of PEN America's Freedom to Read program and a co-lead author of the report, which comes as the free expression and human rights group is under fire from critics who say it's ignoring Palestinian writers during Israel's genocidal war on Gaza.

The report found that Florida again had the highest number of banned books, with 3,135 proscribed titles across 11 school districts. In Wisconsin, PEN America recorded 481 banned books in three districts—including 444 titles blacklisted in the Elkhorn Area School District following one parent's request. Iowa and Texas—with 142 and 141 forbidden titles, respectively—round out the report's top four book-banners.

According to PEN America:

While censors continue to use the concept of "obscenity" to justify widespread books bans, the report examines a wave of intense scrutiny over books that discuss women, sexual violence, and rape. This concerted focus comes amid an epidemic of sexual violence in the United States. The report also finds that books discussing race and racism, LGBTQ+ and especially transgender identities continue to be targeted at consistently high rates.

Book-banners continued to lean heavily upon "anti-obscenity" laws and exaggerated claims of "pornography in schools" in attempts to justify prohibiting books about sexual violence and LGBTQ+ issues. This has resulted in the disproportionate targeting of queer, nonbinary, and women authors. Similarly, the conservative fixation on purging critical race theory and "woke ideology" is undermining efforts to ensure school libraries are diverse and inclusive.

"Book bans are targeting narratives about race and sexual identities and sexual content writ large, and they show no sign of stopping," said Baêta. "The bans we're seeing are broad, harsh, and pernicious—and they're undermining the education of millions of students across the country."

But people are fighting back against what PEN America calls the "Ed Scare."

"Galvanized by the actions of the very students most impacted by book bans, a broad coalition of educators, librarians, parents, authors, and advocates are organizing in ways large and small to protect the freedom to read," the report notes.

PEN America Freedom to Read program director Kasey Meehan, another co-lead author of the report, said that "students are at the epicenter of the book-banning movement, and they're fearlessly spearheading the fight against this insidious encroachment into what they can read and learn across the country."

"By suppressing these stories, censors seek to delegitimize experiences that resonate deeply with young people," Meehan added. "Just as we've seen the power of America's youth in rallying around causes such as gun violence prevention, they're refusing to yield to the censorship of book bans threatening their peers and communities."

Keep ReadingShow Less

Young People to World Leaders: 'Time to Let Youth Lead'

"We need more young people represented in all spheres of decision-making—within government, at the United Nations, in civil society, private sector, and academia. And they must be taken seriously."

Apr 16, 2024

"We still believe in the promise of a better world for all. Do you?"

That's how a letter to world leaders, spearheaded by the United Nations Youth Office, begins. It was released Monday, ahead of the U.N. Economic and Social Council (ECOSOC) Youth Forum, as part of a campaign arguing that "it's time to let youth lead."

The letter stresses that "all around us, humanity is in peril. The impacts of war and conflict, humanitarian catastrophes, the mental health crisis, and the climate emergency have reached unimaginable heights."

"To rebuild trust and restore hope, we need to see meaningful youth engagement become the norm at all levels."

Last year was the hottest in human history, and temperatures in recent months suggest that trend will continue—largely thanks to planet-heating pollution from fossil fuels. Thousands of children have been killed in fighting around the world, from Ukraine and Sudan to the Gaza Strip—where the death toll has helped spur a genocide case against Israel at the International Court of Justice.

"But we know that it doesn't need to be this way. While no one nation can solve these challenges alone, it is the inability of leaders to work together in pursuit of the collective good that is putting our common future in jeopardy," the letter states. "We cannot afford to lose hope—the stakes are simply too high. That is why, as young people and allies, we are rallying together as a global community to make our voices heard."

Emphasizing how including diverse perspectives helps to "ensure we don't continue to repeat past mistakes" and that the youth "will live with the consequences of the decisions taken today," the letter calls on "all leaders and institutions to take immediate action to make global policymaking and decision-making spaces more representative of the communities they serve."

"We need more young people represented in all spheres of decision-making—within government, at the United Nations, in civil society, private sector, and academia. And they must be taken seriously," it argues. "To rebuild trust and restore hope, we need to see meaningful youth engagement become the norm at all levels, backed by dedicated resourcing everywhere around the world."

According to the youth, "The Summit of the Future this September will be one important opportunity for governments to commit to finally giving young people their rightful seat at the table."

The summit's U.N. webpage describes it as "a once-in-a-generation opportunity to enhance cooperation on critical challenges and address gaps in global governance, reaffirm existing commitments including to the sustainable development goals (SDGs) and the United Nations Charter, and move towards a reinvigorated multilateral system that is better positioned to positively impact people's lives."

Ahead of that summit, ECOSOC is hosting the youth forum from Tuesday through Thursday at U.N. headquarters in New York City. Attendees are set to share recommendations and ideas in preparation for the September event.

The young people joining the forum are also expected to participate in discussions focused on five SDGs: partnerships for the goals, no poverty, zero hunger, climate action, and peace, justice, and strong institutions.

"The energy and conviction of young people are infectious, and more vital than ever. Our world is bristling with challenges, tragedies and injustices—many of them linked," U.N. Secretary-General António Guterres said in remarks to the forum on Tuesday.

"In the face of all these crises, public trust is plummeting. Alienation is growing. And the international system is creaking. The future of multilateralism is at stake. And so we need action and we need justice," he continued. "I salute young people around the world for standing up, speaking out and working for real change. We need you. And I am fully committed to bringing young people into political decision-making; not just listening to your views, but acting on them."

Guterres noted that "we established a new Youth Office in the United Nations to advance advocacy, coordination, participation, and accountability for and with young people."

"We will renew the United Nations Youth Strategy—to take this work to the next level. And I am committed to making sure young people have a strong role as we gear up for the Summit of the Future in September," he pledged, detailing various other initiatives.

"Every generation serves as caretaker of this world. Let's be honest: Mine has been careless with that responsibility," said the 74-year-old U.N. chief. "But yours gives me hope. The United Nations stands with you. Together, let's deliver justice. Let's deliver solutions. And let's create a world of peace and prosperity for all."

Keep ReadingShow Less

Most Popular