September, 29 2016, 03:45pm EDT

Wells Fargo's Cross-Selling Mania Goes Back More Than 15 Years

Public Citizen Report Calls Into Question Whether Widespread Fraud Existed Well Before Time Period for Which Bank Agreed to Government Fines

WASHINGTON

Wells Fargo aggressively sought to drive up its "cross-selling" numbers for at least a decade prior to the period for which it was recently fined $185 million for fraudulent sales practices, according to a new Public Citizen report (PDF).

Public Citizen's report (PDF), "The 'King of Cross-Sell' and the Race to Eight," documents that Wells Fargo increased its reported number of products per customer in every year from 1998 to 2009 and that its streak was snapped only after it incorporated data from newly acquired Wachovia Bank, according to its annual reports.

Wells Fargo's reported number of products-per-customer rose more markedly from 1998 to 2009 than in the 2011 to 2016 period, during which the U.S. Consumer Financial Protection Bureau alleges that the bank opened more than 2 million accounts that may not have been fully authorized by its customers.

"Wells Fargo's never-ending quest for higher cross-sell numbers and its pressure-cooker atmosphere produced fertile ground for fraudulent activities," said Michael Tanglis, senior researcher for Public Citizen's Congress Watch division and author of the report. "While much of the focus has been on 2011 to present, Wells' own cross-sell data indicates that from 1998 through 2009 it hit record numbers each year. This demands further scrutiny. The public deserves to know: How long has this been going on?"

The increases occurred as a result of a concerted effort. As early as 1999, Wells Fargo was tracking the number of products sold per day by each banker and wrote in its annual report that it was "going for gr-eight product packages," a word-play that incorporated Wells Fargo's goal of achieving eight products per customer.

As early as 2000, Wells Fargo was already selling more products per customer than today's industry average, yet still expressed dissatisfaction, saying: "We're headed in the right direction but not fast enough."

In 2010, the bank said that it had been pursuing cross-selling strategies for a quarter century and had been dubbed "the king of cross-sell."

Anecdotal reports suggest that the bank may have engaged in fraud well before the time period for which it has agreed to fines. One former Wells Fargo branch manager told CNN that she was instructed in 2007 to require the employees reporting to her to open unauthorized accounts.

In Public Citizen's view, these details underscore the need for an investigation into Wells Fargo's actions prior to 2011.

Public Citizen is a nonprofit consumer advocacy organization that champions the public interest in the halls of power. We defend democracy, resist corporate power and work to ensure that government works for the people - not for big corporations. Founded in 1971, we now have 500,000 members and supporters throughout the country.

(202) 588-1000LATEST NEWS

'Call Your Senator Now': Privacy Advocates Ramp Up Effort to Stop Spying Expansion

"Make no mistake," said one expert, "the day will come when there is a president in the White House who will not hesitate to make full use of the Orwellian power this bill provides."

Apr 16, 2024

With the U.S. Senate poised to vote later this week on legislation to reauthorize a heavily abused warrantless surveillance authority, privacy advocates are ramping up pressure on lawmakers to remove a provision that would force a wide range of businesses and individuals to take part in government spying operations.

Dubbed the "Make Everyone a Spy" provision by one advocacy group, the language was tucked into a House-passed bill that would extend Section 702 of the Foreign Intelligence Surveillance Act (FISA), which allows U.S. agencies to spy on non-citizens located outside of the country without a warrant. Americans' communications have frequently been collected under the spying authority.

The provision that has sparked grave warnings from privacy advocates was spearheaded by the chair of the House Permanent Select Committee on Intelligence, Rep. Mike Turner (R-Ohio), and the panel's ranking member, Rep. Jim Himes (D-Conn.).

While supporters of the provision, including the Biden White House, claim the proposed change to existing law is narrow, civil liberties defenders say it's anything but.

Currently, U.S. agencies can use Section 702 authority to collect the data of non-citizens abroad from electronic communications service providers such as Google, Verizon, and AT&T without a warrant.

The Turner-Himes amendment would significantly expand who could be ordered to cooperate with government surveillance efforts, broadening Section 702 language to encompass "any other service provider who has access to equipment that is being or may be used" to transmit or store electronic communications.

That change, privacy advocates say, would mean grocery stores, laundromats, gyms, barber shops, and other businesses would potentially be conscripted to serve as government spies.

"The Make Everyone a Spy provision is recklessly broad and a threat to democracy itself," Sean Vitka, policy director of Demand Progress, said in a statement Tuesday. "It is simply stunning that the administration and House Intelligence Committee do not have a single answer for how frighteningly broad this provision is."

"You can't create a surveillance state and just hope the government won't take advantage."

The New York Timesexplained Tuesday that after the FISA Court "approves the government's annual requests seeking to renew the program and setting rules for it, the administration sends directives to 'electronic communications service providers' that require them to participate."

In 2022, the Times noted, the FISA Court "sided with an unidentified company that had objected to being compelled to participate in the program because it believed one of its services did not fit the necessary criteria." Unnamed people familiar with the matter told the newspaper that "the judges found that a data center service does not fit the legal definition of an 'electronic communications service provider'"—prompting the bipartisan effort to expand the reach of Section 702.

"While the Department of Justice wants us to believe that this is simply about addressing data centers, that is no justification for exposing cleaning crews, security guards, and untold scores of other Americans to secret Section 702 directives, which are issued without any court review," Vitka said Tuesday. "Receiving one can be a life-changing event, and Jim Himes appears not to have any sense of that. The Senate must stop this provision from advancing."

Elizabeth Goitein, co-director of the Liberty and National Security Program at the Brennan Center for Justice, wrote on social media Tuesday that "it's critical to stop this bill."

"The administration claims it has no intent to use this provision so broadly—and who knows, maybe it doesn't. But the plain language of the bill allows involuntary conscription of much of the private sector for [National Security Agency] surveillance purposes," Goitein wrote. "Make no mistake, the day will come when there is a president in the White House who will not hesitate to make full use of the Orwellian power this bill provides. You can't create a surveillance state and just hope the government won't take advantage."

URGENT: Please read thread below. We have just days to convince the Senate NOT to pass a “terrifying” law (@RonWyden) that will force U.S. businesses to serve as NSA spies. CALL YOUR SENATOR NOW using this call tool (click below or call 202-899-8938). 1/25 https://t.co/HAOHURZoJQ

— Elizabeth Goitein (@LizaGoitein) April 15, 2024

With Section 702 set to expire Friday, Senate Majority Leader Chuck Schumer (D-N.Y.) said in a floor speech Tuesday that he has placed the House-passed FISA legislation on the chamber's calendar and will soon "file cloture on the motion to proceed" to the bill, which is titled the Reforming Intelligence and Securing America Act (RISAA).

"We don't have much time to act," said Schumer. "Democrats and Republicans are going to have to work together to meet the April 19th deadline. If we don't cooperate, FISA will expire, so we must be ready to cooperate."

Sen. Ron Wyden (D-Ore.), a member of the Senate Select Committee on Intelligence and outspoken privacy advocate, has called RISAA's proposed expansion of government surveillance "terrifying" and warned it would "force any American who installs, maintains, or repairs anything that transmits or stores communications to spy on the government's behalf."

According to the Times, Wyden's office has in recent days been circulating "a warning that the provision could be used to conscript someone with access to a journalist's laptop to extract communications between that journalist and a hypothetical foreign source who was targeted for intelligence."

In a social media post on Tuesday, Wyden echoed campaigners in urging people to contact their senators.

"Congress wants to make it easier for the government to spy on you without a warrant," Wyden wrote. "Scared? Me too. Call your senator at (202) 224-3121 before April 19 and tell them to vote NO on expanding warrantless government surveillance under FISA."

Keep ReadingShow Less

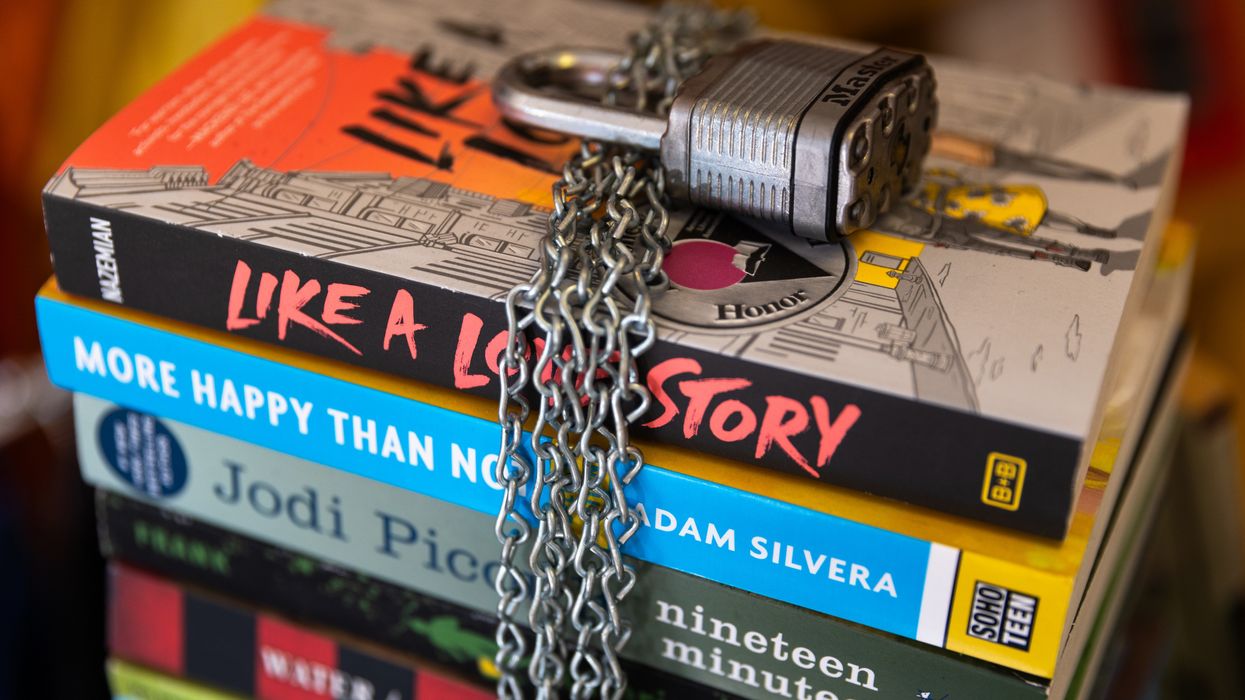

'Ed Scare' Deepens as 4,000+ Book Banned in First Half of School Year

"The bans we're seeing are broad, harsh, and pernicious—and they're undermining the education of millions of students across the country," said one lead author of a new PEN America report.

Apr 16, 2024

U.S. school districts banned more books during the first half of the current academic year than during the entire last scholastic year, a report published Tuesday revealed.

PEN America recorded 4,349 book bans across 52 school districts in 23 states during the fall 2023 semester, more than double the 1,841 titles that were prohibited during the spring term and more than the 3,362 volumes reported banned nationwide during the entire previous academic year.

"For anyone who cares about the bedrock of American values and the protection of free expression, this report should be a red alert," said Sabrina Baêta, manager of PEN America's Freedom to Read program and a co-lead author of the report, which comes as the free expression and human rights group is under fire from critics who say it's ignoring Palestinian writers during Israel's genocidal war on Gaza.

The report found that Florida again had the highest number of banned books, with 3,135 proscribed titles across 11 school districts. In Wisconsin, PEN America recorded 481 banned books in three districts—including 444 titles blacklisted in the Elkhorn Area School District following one parent's request. Iowa and Texas—with 142 and 141 forbidden titles, respectively—round out the report's top four book-banners.

According to PEN America:

While censors continue to use the concept of "obscenity" to justify widespread books bans, the report examines a wave of intense scrutiny over books that discuss women, sexual violence, and rape. This concerted focus comes amid an epidemic of sexual violence in the United States. The report also finds that books discussing race and racism, LGBTQ+ and especially transgender identities continue to be targeted at consistently high rates.

Book-banners continued to lean heavily upon "anti-obscenity" laws and exaggerated claims of "pornography in schools" in attempts to justify prohibiting books about sexual violence and LGBTQ+ issues. This has resulted in the disproportionate targeting of queer, nonbinary, and women authors. Similarly, the conservative fixation on purging critical race theory and "woke ideology" is undermining efforts to ensure school libraries are diverse and inclusive.

"Book bans are targeting narratives about race and sexual identities and sexual content writ large, and they show no sign of stopping," said Baêta. "The bans we're seeing are broad, harsh, and pernicious—and they're undermining the education of millions of students across the country."

But people are fighting back against what PEN America calls the "Ed Scare."

"Galvanized by the actions of the very students most impacted by book bans, a broad coalition of educators, librarians, parents, authors, and advocates are organizing in ways large and small to protect the freedom to read," the report notes.

PEN America Freedom to Read program director Kasey Meehan, another co-lead author of the report, said that "students are at the epicenter of the book-banning movement, and they're fearlessly spearheading the fight against this insidious encroachment into what they can read and learn across the country."

"By suppressing these stories, censors seek to delegitimize experiences that resonate deeply with young people," Meehan added. "Just as we've seen the power of America's youth in rallying around causes such as gun violence prevention, they're refusing to yield to the censorship of book bans threatening their peers and communities."

Keep ReadingShow Less

Young People to World Leaders: 'Time to Let Youth Lead'

"We need more young people represented in all spheres of decision-making—within government, at the United Nations, in civil society, private sector, and academia. And they must be taken seriously."

Apr 16, 2024

"We still believe in the promise of a better world for all. Do you?"

That's how a letter to world leaders, spearheaded by the United Nations Youth Office, begins. It was released Monday, ahead of the U.N. Economic and Social Council (ECOSOC) Youth Forum, as part of a campaign arguing that "it's time to let youth lead."

The letter stresses that "all around us, humanity is in peril. The impacts of war and conflict, humanitarian catastrophes, the mental health crisis, and the climate emergency have reached unimaginable heights."

"To rebuild trust and restore hope, we need to see meaningful youth engagement become the norm at all levels."

Last year was the hottest in human history, and temperatures in recent months suggest that trend will continue—largely thanks to planet-heating pollution from fossil fuels. Thousands of children have been killed in fighting around the world, from Ukraine and Sudan to the Gaza Strip—where the death toll has helped spur a genocide case against Israel at the International Court of Justice.

"But we know that it doesn't need to be this way. While no one nation can solve these challenges alone, it is the inability of leaders to work together in pursuit of the collective good that is putting our common future in jeopardy," the letter states. "We cannot afford to lose hope—the stakes are simply too high. That is why, as young people and allies, we are rallying together as a global community to make our voices heard."

Emphasizing how including diverse perspectives helps to "ensure we don't continue to repeat past mistakes" and that the youth "will live with the consequences of the decisions taken today," the letter calls on "all leaders and institutions to take immediate action to make global policymaking and decision-making spaces more representative of the communities they serve."

"We need more young people represented in all spheres of decision-making—within government, at the United Nations, in civil society, private sector, and academia. And they must be taken seriously," it argues. "To rebuild trust and restore hope, we need to see meaningful youth engagement become the norm at all levels, backed by dedicated resourcing everywhere around the world."

According to the youth, "The Summit of the Future this September will be one important opportunity for governments to commit to finally giving young people their rightful seat at the table."

The summit's U.N. webpage describes it as "a once-in-a-generation opportunity to enhance cooperation on critical challenges and address gaps in global governance, reaffirm existing commitments including to the sustainable development goals (SDGs) and the United Nations Charter, and move towards a reinvigorated multilateral system that is better positioned to positively impact people's lives."

Ahead of that summit, ECOSOC is hosting the youth forum from Tuesday through Thursday at U.N. headquarters in New York City. Attendees are set to share recommendations and ideas in preparation for the September event.

The young people joining the forum are also expected to participate in discussions focused on five SDGs: partnerships for the goals, no poverty, zero hunger, climate action, and peace, justice, and strong institutions.

"The energy and conviction of young people are infectious, and more vital than ever. Our world is bristling with challenges, tragedies and injustices—many of them linked," U.N. Secretary-General António Guterres said in remarks to the forum on Tuesday.

"In the face of all these crises, public trust is plummeting. Alienation is growing. And the international system is creaking. The future of multilateralism is at stake. And so we need action and we need justice," he continued. "I salute young people around the world for standing up, speaking out and working for real change. We need you. And I am fully committed to bringing young people into political decision-making; not just listening to your views, but acting on them."

Guterres noted that "we established a new Youth Office in the United Nations to advance advocacy, coordination, participation, and accountability for and with young people."

"We will renew the United Nations Youth Strategy—to take this work to the next level. And I am committed to making sure young people have a strong role as we gear up for the Summit of the Future in September," he pledged, detailing various other initiatives.

"Every generation serves as caretaker of this world. Let's be honest: Mine has been careless with that responsibility," said the 74-year-old U.N. chief. "But yours gives me hope. The United Nations stands with you. Together, let's deliver justice. Let's deliver solutions. And let's create a world of peace and prosperity for all."

Keep ReadingShow Less

Most Popular