April, 18 2016, 08:30am EDT

Patriotic Millionaires' Chair Slams The New Yorker On "Patriotic Philanthropy"

Morris Pearl says “This issue cuts to the core of our democracy. It requires journalistic straight-shooting, not equivocation.”

NEW YORK

Today, the Morris Pearl, Chair of the Patriotic Millionaires released a hard-hitting opinion in response to the New Yorker's article, in which Pearl is quoted, entitled "The Billionaires' Loophole."

Proudly "traitors to their class", the Patriotic Millionaires are dedicated to ending the wholesale corruption of our tax code and implementing a fair tax system that can adequately fund our citizens' common interests.

Other members include: the founder of Men's Wearhouse George Zimmer, founder of MOMs Organic Market Scott Nash, several Google engineers including employee number 20 and number 59 David desJardins and Doug Edwards respectively, filmmaker Abigail Disney, textile entrepreneur Great Neck Richman, corrugated cardboard mogul Dennis Mehiel and many other high net worth individuals from across the country. You can find the full list at https://patrioticmillionaires.org/who-we-are/

As Americans across the country finalize their tax returns today, the Patriotic Millionaires will be available for media appearances and on-the-record interviews in cities across the country all this week.

Read Morris Pearl's full response below and on Medium:

Patriotic Philanthropy?

Alec MacGillis' piece "The Billionaires' Loophole," published March 14, 2016, ostensibly explores the fairness of the carried interest tax loophole, a giveaway to fund managers that "helps" increase their capacity to charitably fund projects that the government isn't able to complete. The help comes in the form of preferential tax treatment which allows fund managers to pay a capital gains rate of 20% on income that by any reasonable measure should be considered "ordinary income."

As a case in point, MacGillis (who interviewed and quoted me in the piece) focuses on billionaire David Rubenstein, whose self-proclaimed "patriotic philanthropy" helped repair the Washington Monument after an earthquake and build a gallery to house the Magna Carta, among other things. In his piece, MacGillis offers a detailed history on the loophole and the rise of Rubinstein through the ranks of America's wealthiest citizens, but he fails to convey the important truth about the "Billionaire loophole," which is that as commendable as Mr. Rubenstein's giving may be, it is no justification for a tax loophole that benefits only a few thousand millionaires and billionaires.

On one hand, Rubinstein uses his wealth to preserve various artifacts of American history. On the other, he uses his wealth to convince lawmakers to maintain a preferential and fundamentally unfair tax status for himself and other millionaires and billionaires. There's nothing patriotic or philanthropic about subverting the fabric of our democracy.

MacGillis does not go far enough in detailing the extent of this corruption as it relates to carried interest. He does note how Rubenstein and other private equity fund managers worked to block Senate attempts to kill the loophole and quotes John Boehner, who when asked about Republican congressman Dave Camp's 2014 effort to overhaul the tax code and kill carried interest replied, "Blah, blah, blah." But he makes no mention of the fact that Boehner's former Chief of Staff Mike Sommers was recently named president of the Private Equity Growth Capital Council (PEGCC), a trade association for Wall Street fund managers that is at the center of the fight to defend the carried interest loophole.

He also fails to mention that Ken Mehlman, former Chair of the Republican National Committee, is the Chair of the PEGCC. It's pretty clear that private equity leaders understand there is no intellectually justifiable reason to keep the loophole open, so they are pulling in top influence peddlers to do the job for them. If the issue runs deep, MacGillis's piece doesn't reach its depths.

It doesn't do to well in the shallows either. The basic premise of the article deserves reexamination. MacGillis asserts that the loophole "helps" Rubenstein perform philanthropic acts by giving him more money with which to perform laudable acts, but if Rubenstein's net worth is $2.6 billion, his gift of $7.5 million to help repair the Washington Monument amounted to only 0.29% of his net worth. This is the equivalent of a person with a net worth of $100,000 giving away only $290. It is proverbial chump change to a billionaire.

And can we consider the great hypocrisy of Rubenstein paying to repair the Washington Monument? General George Washington led a war, costing thousands upon thousands of lives, that was waged over the very issue of unjust taxation. Two hundred and thirty years later, the cancer of money in politics -- as epitomized by the gross wealth and political power of players like Rubenstein -- threatens to destroy that very same democracy. People like Rubenstein metastasize that cancer.

This brand of injustice deserves a much stronger treatment than was provided in MacGillis' piece. The carried interest loophole is the poster child for the problem of money in politics. This issue cuts to the core of our democracy. It requires journalistic straight-shooting, not equivocation. If Americans are to have any faith in our government, leaders must close this loophole immediately. Stalling its closure is tantamount to subverting our democracy. Rather than relying on "patriotic philanthropy" to save the Washington Monument, we should make every effort to actually realize the fundamental principles for which our first president fought.

The Patriotic Millionaires is a group of high-net worth Americans who share a profound concern about the destabilizing level of inequality in America. Our work centers on the two things that matter most in a capitalist democracy: power and money. Our goal is to ensure that the country's political economy is structured to meet the needs of regular Americans, rather than just millionaires. We focus on three "first" principles: a highly progressive tax system, a livable minimum wage, and equal political representation for all citizens.

(202) 446-0489LATEST NEWS

House Dems Voice 'Deep Concern' Over Biden Claim That Israel Is Legally Using US Arms

A letter from 26 lawmakers notes the "stark differences and gaps" between what Biden administration officials say and the opinions of "prominent experts and global institutions" accusing Israel of genocide.

Apr 16, 2024

More than two dozen House Democrats on Tuesday challenged the Biden administration's claim that Israel is using U.S.-supplied weapons in compliance with domestic and international law—an assertion made amid an ongoing World Court probe of "plausibly" genocidal Israeli policies and practices in Gaza.

Citing "mounting credible and deeply troubling reports and allegations" of human rights crimes committed by Israeli troops in Gaza and soldiers and settlers in the occupied West Bank, 26 congressional Democrats led by Texas Reps. Veronica Escobar—who co-chairs President Joe Biden's reelection campaign—and Joaquin Castro asked U.S. Defense Secretary Lloyd Austin, Secretary of State Antony Blinken, and Director of National Intelligence Avril Haines "whether and how" their agencies determined Israel is lawfully using arms provided by Washington.

"We write to express our deep concern regarding the U.S. Department of State's recent comments regarding assurances from the Israeli government, under National Security Memorandum (NSM) 20, that the Israeli government is using U.S.-origin weapons in full compliance with relevant U.S. and international law and is not restricting the delivery of humanitarian assistance," the lawmakers wrote in a letter to the Cabinet members.

The letter acknowledges the "grave concerns" of institutions and experts around the world regarding Israel's "conduct throughout the war in Gaza, its policies regarding civilian harm and military targeting, unauthorized expansion of settlements and settler violence in the West Bank, and potential use of U.S. arms by settlers, in additional to limitations on humanitarian aid supported by the U.S."

The legislators noted Israeli attacks on aid convoys, workers, and recipients—like the February 29 "

Flour Massacre" in which nearly 900 starving Palestinians were killed or wounded at a food distribution site—and "the closure of vital border crossings" as Gazan children starve to death as causes for serious concern.

While the lawmakers didn't mention the International Court of Justice's January 26

preliminary finding that Israel is "plausibly" committing genocide in Gaza, their letter highlights the "stark differences and gaps in the statements" made by Biden administration officials and "those made by prominent experts and global institutions"—many of whom accuse Israel of genocide.

The lawmakers' letter came amid reports of fresh Israeli atrocities, including a drone strike on a playground in the Maghazi refugee camp in northern Gaza that killed at least 11 children. Eyewitnesses described a "horrific scene of children torn apart."

While Biden has called out Israel's "indiscriminate bombing" in Gaza—much of it carried out using U.S.-supplied warplanes and munitions including 2,000-pound bombs that can level whole city blocks—his administration has approved more than 100 arms sales to Israel, has repeatedly sidestepped Congress to fast-track emergency armed aid, and is seeking to provide the key ally with billions of dollars in addition weaponry atop the nearly $4 billion it gets annually from Washington.

This, despite multiple federal laws—and the administration's own rules— prohibiting U.S. arms transfers to human rights violators.

According to Palestinian and international officials, more than 110,000 Palestinians have been killed or wounded by Israeli forces since October 7. Most of the dead are women and children. At least 7,000 Palestinians are also missing and presumed dead and buried beneath the rubble of hundreds of thousands of bombed-out homes and other buildings.

Around 90% of Gaza's 2.3 million people have been forcibly displaced in what many Palestinians are calling a second Nakba, a reference to the ethnic cleansing of over 750,000 Arabs from Palestine during the establishment of the modern state of Israel in 1948.

A growing number of not only progressive lawmakers but also mainstream Democrats are calling for a suspension of U.S. military aid to Israel.

On Tuesday, Sen. Bernie Sanders (I-Vt.)—who was criticized earlier in the war for not calling for a cease-fire—stood beside a photo of a starving Gazan girl while declaring "no more money for" the far-right government of Israeli Prime Minister Benjamin Netanyahu and his "war machine."

Keep ReadingShow Less

'Weasel Words': Julian Assange's Wife Slams US Assurances to UK

"The diplomatic note does nothing to relieve our family's extreme distress about his future—his grim expectation of spending the rest of his life in isolation in U.S. prison for publishing award-winning journalism."

Apr 16, 2024

The wife of jailed WikiLeaks founder Julian Assange sharply criticized "assurances" the U.S. government made as the U.K. High Court considers allowing the 52-year-old Australian's extradition to the United States, where he faces 175 years in prison.

The U.S. document states that if extradited, "Assange will have the ability to raise and seek to rely upon at trial (which includes any sentencing hearing) the rights and protections given under the First Amendment of the Constitution of the United States," though it points out that "a decision as to the applicability of the First Amendment is exclusively within the purview of the U.S. courts."

"A sentence of death will neither be sought nor imposed on Assange," the document adds, noting that he has not been charged with any offense for which that is a possible punishment. It comes after the U.K. court ruled last month that the Biden administration had until Tuesday to confirm that he wouldn't face the death penalty and if it did not, he could continue appealing his extradition.

Responding on social media, his wife, Stella Assange—who is an attorney—blasted the U.S. assurances as "weasel words."

"The United States has issued a nonassurance in relation to the First Amendment, and a standard assurance in relation to the death penalty," she said. "It makes no undertaking to withdraw the prosecution's previous assertion that Julian has no First Amendment rights because he is not a U.S citizen."

"The Biden administration must drop this dangerous prosecution before it is too late."

"Instead, the U.S. has limited itself to blatant weasel words claiming that Julian can 'seek to raise' the First Amendment if extradited," she added. "The diplomatic note does nothing to relieve our family's extreme distress about his future—his grim expectation of spending the rest of his life in isolation in U.S. prison for publishing award-winning journalism. The Biden administration must drop this dangerous prosecution before it is too late."

The U.K. court's next hearing is scheduled for May 20. Last week, reporters asked U.S. President Joe Biden about requests from Australian Prime Minister Anthony Albanese and members of the country's Parliament to drop the extradition effort and charges. He said that "we're considering it."

So far, the Biden administration has ignored significant pressure from Australian and U.S. politicians as well as human rights and press freedom groups, and continued to pursue the extradition of Julian Assange, who was charged under former President Donald Trump—the Republican expected to face the Democratic president in the November election.

Assange was charged under the Espionage Act and Computer Fraud and Abuse Act for publishing classified documents including the "Collateral Murder" video and the Afghan and Iraq war logs. Since British authorities dragged Assange out of the Ecuadorian Embassy in London—where he lived with political asylum for seven years—he has been jailed in the city's Belmarsh Prison.

The WikiLeaks founder's wife, with whom he has two children, was not alone in condemning the U.S. assurances on Tuesday.

"This 'assurance' should make journalists even more worried about how the Assange prosecution could impact press freedom in the U.S. and globally. The U.K. should grant Assange's appeal and refuse to extradite him," said the Freedom of the Press Foundation. "The U.S. doesn't disclaim the ability to argue that the First Amendment doesn't apply to Assange because of his nationality or other reasons, or for a court to rule against a First Amendment challenge to his prosecution."

Jameel Jaffer, director of the Knight First Amendment Institute, similarly said that "no one who cares about press freedom should take any comfort at all from the United States' assurance that Assange will be permitted to 'rely upon' the First Amendment."

"If the prosecution goes forward, the U.S. government will be trying to persuade American courts that the First Amendment poses no bar to the prosecution of a publisher under the Espionage Act," Jaffer warned. "And if the government is successful, no journalist will ever again be able to publish U.S. government secrets without risking her liberty."

"So the government's First Amendment assurances aren't responsive at all to the concerns that press freedom advocates have been raising," he concluded. "This case poses essentially the same threat to press freedom today as it did yesterday."

Keep ReadingShow Less

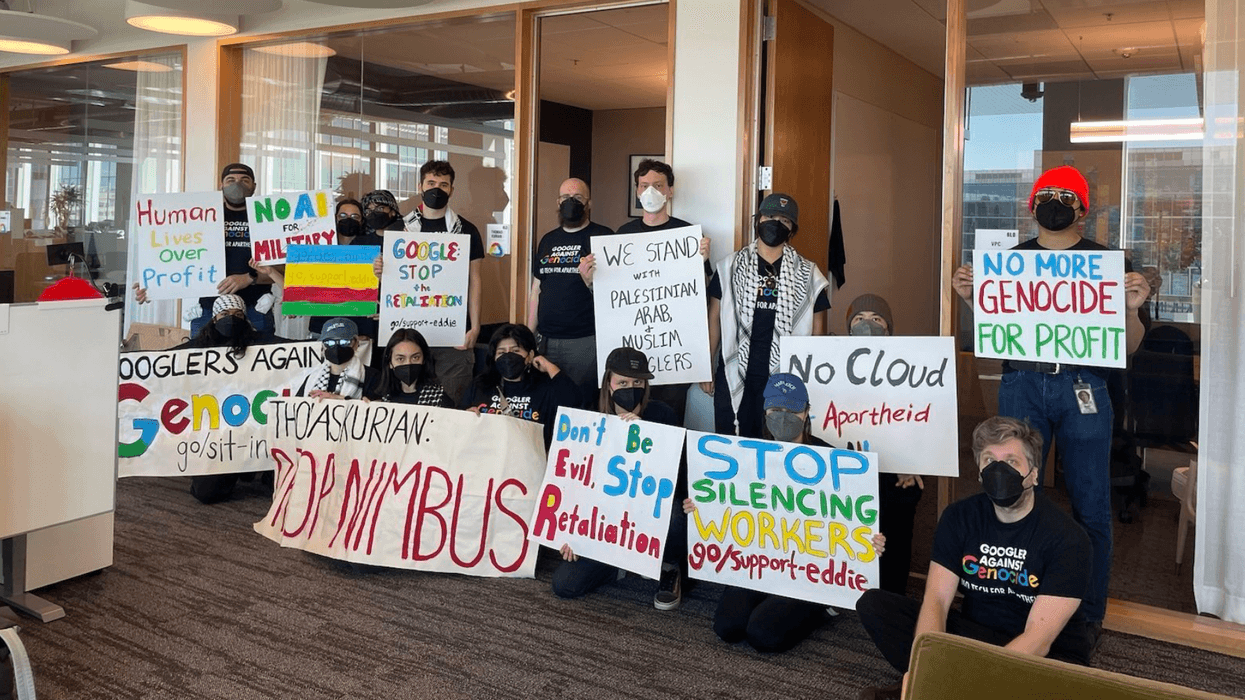

Workers Stage Sit-Ins to Demand Google End Israeli Cloud Contract

"Just as people of conscience demanded institutions cut ties with apartheid South Africa in the 1980s, the time is now to rise up in support of Palestinian human rights," said Google employees in an open letter.

Apr 16, 2024

Following recent reports that Google may soon expand its tech collaboration with the Israeli government, dozens of the company's employees on Tuesday entered its offices in New York City and Sunnyvale, California and announced that they wouldn't leave until executives pull out of its $1.2 billion cloud services and data contract with the country.

The No Tech for Apartheid coalition—including the Muslim-led MPower Change and the Jewish-led Jewish Voice for Peace—organized the sit-in, which marks an escalation in Google workers' protests against Project Nimbus, the 2021 contract under which Google and Amazon provide cloud infrastructure across Israel's government.

The deal includes a stipulation that the companies cannot prevent Israel from using Project Nimbus for any government agency, including the Israel Defense Forces (IDF)—which means Google employees' work may be directly supporting the country's assault on the Gaza and its killing of at least 33,843 Palestinians since October.

"Workers will NOT allow business as usual while Google continues to profit from the genocide of Palestinians in Gaza," said MPower Change.

In Sunnyvale, workers began occupying the office of Google Cloud CEO Thomas Kurian, while employees in the company's New York office began a sit-in in a common space.

Outdoor rallies were also scheduled to take place in San Francisco and Seattle, with both Amazon and Google employees attending.

Former Google cloud software engineer Eddie Hatfield, who was fired last month for disrupting a Google Israel event, was among those who protested in New York.

The sit-ins came a week after Time magazine reported that Google has entered further negotiations with the Israeli government in recent weeks, even as international human rights experts raise alarm that Israeli officials have directly caused famine to take hold in parts of Gaza by blocking humanitarian aid.

No Tech for Apartheid released an open letter addressed to Kurian and other Google and Amazon executives, saying that as long as the companies' "tech continues to power the Israeli military and government, [they] are actively complicit in this genocide."

"Your workers do not want to be complicit in genocide," reads the letter, which has been signed by 93,000 supporters. "Just as people of conscience demanded institutions cut ties with apartheid South Africa in the 1980s, the time is now to rise up in support of Palestinian human rights, to end the Project Nimbus contract, and join calls to end the Israeli occupation and siege of Gaza. This has never been more urgent. We hope that you will take this opportunity to be on the right side of history. End the Project Nimbus contract and reestablish your companies' commitments to human rights."

Keep ReadingShow Less

Most Popular