May, 03 2013, 03:04pm EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement by Chad Stone, Chief Economist, on the April Employment Report

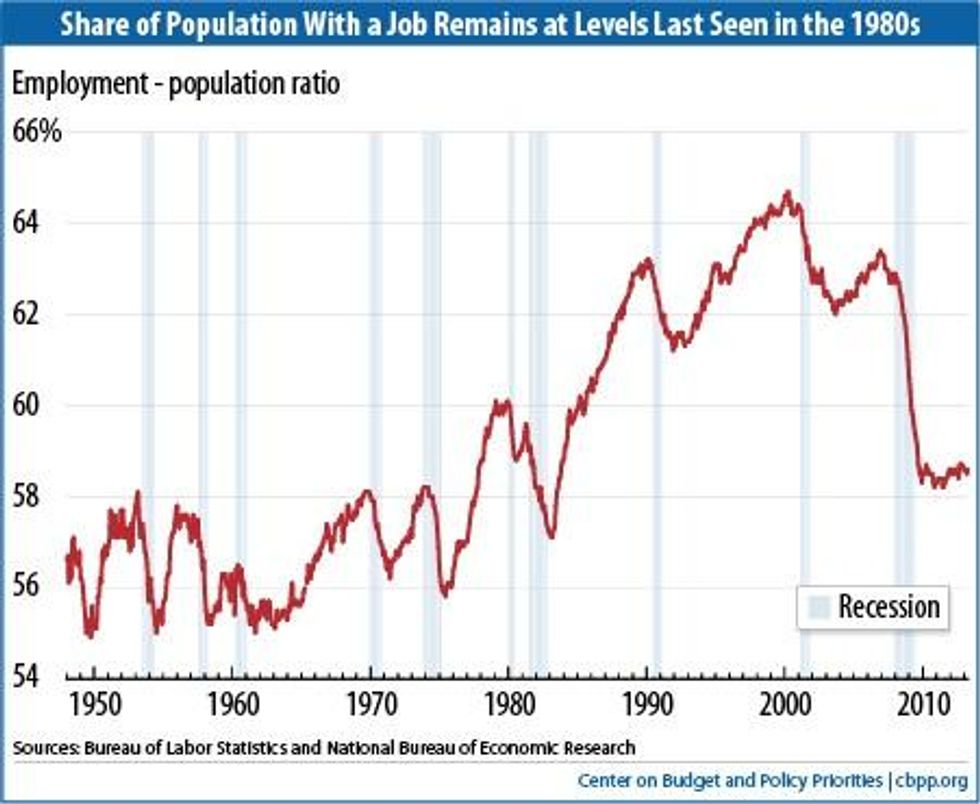

Today's jobs report shows that labor markets still bear the scars of the Great Recession despite 38 straight months of private-sector job growth and a drop in the unemployment rate from 7.9 percent to 7.5 percent since January. Unemployment remains stubbornly high and many people who would likely have a job in a stronger economy are not even looking for work. Consequently, the share of the population with a job remains well below what it was over the two decades before the recession started in December 2007 (see chart).

WASHINGTON

Today's jobs report shows that labor markets still bear the scars of the Great Recession despite 38 straight months of private-sector job growth and a drop in the unemployment rate from 7.9 percent to 7.5 percent since January. Unemployment remains stubbornly high and many people who would likely have a job in a stronger economy are not even looking for work. Consequently, the share of the population with a job remains well below what it was over the two decades before the recession started in December 2007 (see chart).

Some of the recent decline in labor force participation -- the percentage of people 16 or older who are working or actively looking for work -- reflects the aging of the population. Baby boomers are starting to retire and the share of people in their prime working years is falling. But the decline also reflects to an important extent an ongoing dearth of good job prospects. Some people retire earlier than they otherwise would or go on disability when they might be able, in a stronger job market, to find a job that accommodates their disability. Others become discouraged about their job prospects and stop looking until conditions improve. The unemployment rate doesn't reflect those decisions; to be counted as officially unemployed a person must be actively looking for work. But many of those people would start looking for work again if they thought jobs were available.

A robust jobs recovery that both reduces unemployment and brings people back into the labor force requires much faster economic growth than we have seen over the past few years. On the monetary policy side, the Federal Reserve remains committed to accommodating faster growth without raising interest rates at least as long as the unemployment rate remains above 6 1/2 percent and inflation remains contained. The problem is on the fiscal policy side. As the Fed's monetary policymaking committee this week stated flatly, "fiscal policy is restraining economic growth."

For example, lawmakers allowed the payroll tax cut to expire at the end of the year (while extending some of the high-income tax cuts that have much lower job-creating, bang-for-the-buck impacts) because they are focused too much on deficit reduction and not enough on job creation, and because many lawmakers insisted on preserving as much of the high-income tax cuts as possible. They have let sequestration's automatic spending cuts take effect rather than crafting a balanced alternative that would achieve the same deficit reduction over the longer term without hampering the economic recovery (and ideally providing additional short-term infrastructure investment or other stimulus).

The Fed has recognized that unemployment is too high and there is no immediate threat of inflation. It's time for lawmakers to recognize that unemployment is too high and there is no looming debt crisis. Spending money on job creation now is not incompatible with deficit reduction and debt stabilization over the longer run.

About the April Jobs Report

The April jobs report modestly exceeded expectations, but a robust jobs recovery remains elusive, especially since the full effects of sequestration have yet to be felt.

- Private and government payrolls combined rose by just 165,000 jobs in April and job growth in February and March was revised up by a total of 114,000 jobs. Private employers added 176,000 jobs in April, while government employment fell by 11,000. Federal government employment fell by 8,000, state government employment fell by 1,000, and local government employment fell by 2,000.

- This is the 38th straight month of private-sector job creation, with payrolls growing by 6.8 million jobs (a pace of 178,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 6.2 million jobs over the same period, or 162,000 a month. Total government jobs fell by 626,000 over this period, dominated by a loss of 428,000 local government jobs.

- Despite 38 months of private-sector job growth, there were still 2.6 million fewer jobs on nonfarm payrolls and 2.0 million fewer jobs on private payrolls in April than when the recession began in December 2007. April's job growth would be considered solid in an economy that had already largely recovered from the recession, but it is well below the sustained job growth of 200,000 to 300,000 a month that would mark a robust jobs recovery. Job growth in the first four months of 2013 has averaged 196,000 a month, but the pace has slowed considerably over the past two months.

- The unemployment rate was 7.5 percent in April, and 11.7 million people were unemployed. In April, the unemployment rate was 6.7 percent for whites (2.3 percentage points higher than at the start of the recession), 13.2 percent for African Americans (4.2 percentage points higher than at the start of the recession), and 9.0 percent for Hispanics or Latinos (2.7 percentage points higher than at the start of the recession).

- The recession and lack of job opportunities drove many people out of the labor force. After large declines in February and March, the labor force increased in April. Yet it remains 416,000 people smaller than it was in January. The labor force participation rate (the share of people aged 16 and over who are working or actively looking for work) was 63.3 percent in April; the last time it was lower was August 1978.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009, was 58.6 percent in April.

- The Labor Department's most comprehensive alternative unemployment rate measure -- which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can't find full-time jobs -- was 13.9 percent in April. That's down from its all-time high of 17.1 percent in late 2009 (in data that go back to 1994) but still 5.1 percentage points higher than at the start of the recession. By that measure, roughly 22 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. Nearly two-fifths (37.4 percent) of the 11.7 million people who are unemployed -- 4.4 million people -- have been looking for work for 27 weeks or longer. These long-term unemployed represent 2.8 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

Trump Eyes Social Security Cuts By Slashing Payroll Tax

"He is dusting off the old Republican playbook and bringing back the strategy known informally as 'Starve the Beast,'" said one advocate. "In this case, Social Security is the beast."

Apr 18, 2024

Amid new reporting that former U.S. President Donald Trump's economic advisers are urging him to cut the federal payroll tax, a key revenue source for Social Security and Medicare, advocates on Thursday urged voters to remember that the presumptive Republican presidential nominee has long threatened to do just that.

"Don't be fooled," said Nancy Altman, president of Social Security Works, which lobbies to strengthen the social safety net for retired Americans. "At the end of his term in office, Trump delayed Social Security's dedicated revenue paid from workers and their employers. He was quite explicit that, if reelected, he would convert that delay into a permanent cut."

Altman was referring to an executive order Trump signed in August 2020, allowing companies to delay payroll tax payments—an option most companies declined to take as the Treasury Department made clear they would have to pay all of the deferred taxes the following year and that employees would see smaller paychecks as a result of the program.

Trump promised to make the payroll tax cut permanent, and as Reutersreported late Wednesday, the former president is discussing the proposal with economic advisers including Fox News host and former National Economic Council Director Larry Kudlow and right-wing commentator Stephen Moore.

The former president is weighing cuts to Social Security's revenue stream even as Republicans complain that the popular program is unaffordable and push to raise the retirement age to delay Americans' use of the funds.

The GOP has long claimed Social Security is headed toward insolvency and pushed to privatize the program or cut benefits, but last year's Social Security trustees report found that the program's trust fund currently has a $2.85 trillion surplus and could pay 80% of benefits for the next 75 years even if Congress takes no action to expand it—as long as it continues to be funded through taxes.

"Social Security can only pay benefits if it has sufficient dedicated revenue to pay its costs. That is why it doesn't contribute even a penny to the deficit," said Altman. "If Trump succeeds in slashing that dedicated revenue so that it is no longer sufficient to fully cover the cost, it will result in an automatic benefit reduction. This would happen without any Republicans having to vote for the cuts, or Trump having to sign them into law."

"He is dusting off the old Republican playbook and bringing back the strategy known informally as 'Starve the Beast,'" said Altman of Trump. "In this case, Social Security is the beast."

Along with cutting payroll taxes, which are paid by workers and employees and amount to 7.65% of each employee's gross pay in order to fund senior citizens' post-retirement income, Trump has proposed extending the 2017 Tax Cuts and Jobs Act, the vast majority of which benefited the wealthiest Americans, according to the Economic Policy Institute and the Center for Popular Democracy.

Altman noted the contrast between Trump's tax proposals and those of President Joe Biden, who has proposed strengthening Social Security and extending its solvency by requiring people with wealth over $100 million to pay at least 25% in income taxes, raising the corporate tax rate to 28%, and quadrupling the stock buyback tax to disincentive companies lavishing their shareholders with their profits instead of investing in their workforce.

"The choice this election is clear: Trump and the Republicans will cut Social Security and give tax breaks to millionaires and billionaires," said Altman. "The Democrats will expand Social Security, paid for by requiring millionaires and billionaires to pay their fair share."

Keep ReadingShow Less

Watchdogs' Database Details Right-Wing Efforts to Sway US Supreme Court

"Supreme corruption demands supreme transparency," said one campaigner behind the new effort.

Apr 18, 2024

A trio of progressive watchdog groups on Thursday unveiled a new database detailing the "troubling connections" between the U.S. Supreme Court's right-wing justices, the conservative organizations that have intervened in cases before the court, and the wealthy donors funding them.

Take Back the Court, Revolving Door Project, and True North Research published the database at SupremeTransparency.org, which "shines a spotlight on the complex web connecting justices to powerbrokers and the organizations that those powerbrokers fund, lead, and are otherwise linked to."

The watchdogs found that nearly 1 in 7 amicus briefs filed during the 2023-24 Supreme Court term were lodged by at least one powerbroker-affiliated organization. This affects 32 different cases before the court.

"The current U.S. Supreme Court has gone rogue."

For example, in Moore v. United States—in which the Supreme Court could preemptively ban or limit wealth taxes—half of all amicus briefs were filed by groups affiliated with right-wing powerbrokers.

In Loper Bright Enterprises v. Raimondo, groups funded by billionaire industrialist Charles Koch want to scupper the Chevron deference, a 40-year precedent under which judges defer to the legal interpretations of federal agencies if Congress has not passed any laws on an issue. Powerbroker-affiliated organizations have filed more than one-third of the amicus briefs seeking to overturn the Chevron doctrine.

"Far too often people with insidiously close ties to justices like Clarence Thomas and Samuel Alito, such as Harlan Crow and Paul Singer, signal their interest in the outcome of cases by funding, leading, or influencing organizations that file amicus briefs," Revolving Door Project executive director Jeff Hauser said in a statement.

"There is just as much of a conflict of interest when a justice hears a case involving a benefactor as a named party and one in which the person who illicitly enabled their luxurious lifestyle is 'merely' similarly situated to one of the parties," Hauser added.

According to SupremeTransparency.org:

The current U.S. Supreme Court has gone rogue. The right-wing justices that make up the court's supermajority frequently toy with precedent and the rule of law to issue opinions that not only defy the will of a majority of Americans, but also rewrite constitutional principles, overturn widely respected legal precedents, and gut longstanding rules that protect the public interest.

In just the 2021 and 2022 Supreme Court terms alone, the court overturned Roe v. Wadeafter 49 years; gutted both the decades-old Clean Air Act and Clean Water Act; overturned a 100+ year old gun safety law; eroded the National Labor Relations Act (adopted as part of New Deal reforms to protect workers); broke with their own procedures regarding standing to sue in order to block student debt relief; and reversed decades of precedent to end the decadeslong practice of race-conscious college admissions policies that promoted diversity and redressed discrimination. But this radically reactionary court and its radically reactionary justices aren't acting alone.

"Supreme corruption demands supreme transparency," said Take Back the Court president Sarah Lipton-Lubet. "It's no secret that the many of the rich benefactors cozying up to the conservative justices are the same people who fund right-wing organizations with business before the court."

"But too often, stories about the Supreme Court don't connect these dots—and as a result, they leave us with an incomplete picture," she continued. "The truth is right-wing powerbrokers are seemingly paying to play; they're funding groups that are weighing in on court cases even as they buy access to the justices who will rule on those cases."

"It's just one of the ways our Supreme Court is deeply, fundamentally broken," Lipton-Lubet added. "And it's a reminder of how urgent and necessary it is that we reform this corrupt court."

Last year, the Supreme Court adopted a Code of Conduct that contained few new rules, no enforcement mechanism, and was widely panned as a toothless public relations stunt. Bolder proposals for reforming the high court include term limits and increasing the number of justices.

Keep ReadingShow Less

Climate Crisis to Cost Global Economy $38 Trillion a Year by 2050

"This clearly shows that protecting our climate is much cheaper than not doing so, and that is without even considering noneconomic impacts such as loss of life or biodiversity," a new study's lead author said.

Apr 18, 2024

The climate crisis will shrink the average global income 19% in the next 26 years compared to what it would have been without global heating caused primarily by the burning of fossil fuels, a study published in Nature Wednesday has found.

The researchers, from the Potsdam Institute for Climate Impact Research (PIK), said that economic shrinkage was largely locked in by mid-century by existing climate change, but that actions taken to reduce emissions now could determine whether income losses hold steady at around 20% or triple through the second half of the century.

"These near-term damages are a result of our past emissions," study lead author and PIK scientist Leonie Wenz said in a statement. "We will need more adaptation efforts if we want to avoid at least some of them. And we have to cut down our emissions drastically and immediately—if not, economic losses will become even bigger in the second half of the century, amounting to up to 60% on global average by 2100."

"I am used to my work not having a nice societal outcome, but I was surprised by how big the damages were."

Put in dollar terms, the climate crisis will take a yearly $38 trillion chunk out of the global economy in damages by 2050, the study authors found.

"That seems like… a lot," writer and climate advocate Bill McKibben wrote in response to the findings. "The entire world economy at the moment is about $100 trillion a year; the federal budget is about $6 trillion a year."

This means that the costs of inaction have already exceeded the costs of limiting global heating to 2°C by six times, the study authors said. However, limiting warming to 2°C can still significantly reduce economic losses through 2100.

"This clearly shows that protecting our climate is much cheaper than not doing so, and that is without even considering noneconomic impacts such as loss of life or biodiversity," Wenz said.

The damages predicted by the study were more than twice those of similar analyses because the researchers looked beyond national temperature data to also incorporate the impacts of extreme weather and rainfall on more than 1,600 subnational regions over a 40-year period, The Guardian explained.

"Strong income reductions are projected for the majority of regions, including North America and Europe, with South Asia and Africa being most strongly affected," PIK scientist and first author Maximilian Kotz said in a statement. "These are caused by the impact of climate change on various aspects that are relevant for economic growth such as agricultural yields, labor productivity, or infrastructure."

However, Wenz told the paper that the paper's projected reduction was likely a "lower bound" because the study still doesn't include climate impacts such as heatwaves, tropical storms, sea-level rise, and harms to human health.

Unlike previous studies, the research predicted economic losses for most wealthier countries in the Global North, with the U.S. and German economies shrinking by 11% by mid-century, France's by 13%, and the U.K.'s by 7%. However, the countries set to suffer the most are countries closer to the equator that have lower incomes already and have historically done much less to contribute to the climate crisis. Iraq, for example, could see incomes drop by 30%, Botswana 25%, and Brazil 21%.

"Our study highlights the considerable inequity of climate impacts: We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer," study co-author Anders Levermann, who leads Research Department Complexity Science at PIK, said in a statement. "Further temperature increases will therefore be most harmful there. The countries least responsible for climate change, are predicted to suffer income loss that is 60% greater than the higher-income countries and 40% greater than higher-emission countries. They are also the ones with the least resources to adapt to its impacts."

Wenz told The Guardian that the results were "devastating."

"I am used to my work not having a nice societal outcome, but I was surprised by how big the damages were. The inequality dimension was really shocking," Wenz said.

Levermann said the paper presented society with a clear choice:

It is on us to decide: Structural change towards a renewable energy system is needed for our security and will save us money. Staying on the path we are currently on, will lead to catastrophic consequences. The temperature of the planet can only be stabilized if we stop burning oil, gas, and coal.

McKibben, meanwhile, argued that the findings should persuade major companies to embrace climate action for self-interested reasons. He noted that most corporate emissions come from how company money is invested by banks, particularly in the continued exploitation of fossil fuel resources.

"If Amazon and Apple and Microsoft wanted to avoid a world where, by century's end, people had 60% less money to spend on buying whatever phones and software and weird junk (doubtless weirder by then) they plan on selling, then they should be putting pressure on their banks to stop making the problem worse. They should also be unleashing their lobbying teams to demand climate action from Congress," McKibben wrote.

"These people are supposed to care about money, and for once it would help us if they actually did," he continued. "Stop putting out ads about how green your products are—start making this system you dominate actually work."

Keep ReadingShow Less

Most Popular