May, 22 2012, 03:23pm EDT

Bill Introduced to End Conflicts of Interest at the Federal Reserve

WASHINGTON

Sen. Bernie Sanders (I-Vt.) today introduced legislation to prohibit banking industry executives from serving as directors of the 12 Federal Reserve regional banks.

Sen. Barbara Boxer (D-Calif.) is an original co-sponsor of the measure to end conflicts of interest involving regulators and the financial institutions they regulate. She joined Sanders at a Capitol news conference. Sen. Mark Begich (D-Alaska) also is a co-sponsor of the bill.

A Government Accountability Office audit - conducted pursuant to a Sanders provision in the Dodd-Frank Wall Street Reform law - found that allowing members of the banking industry to both elect and serve on the Federal Reserve's board of directors creates "an appearance of a conflict of interest" and poses "reputational risks" to the Federal Reserve System.

The recent multi-billion-dollar trading loss at JPMorgan Chase underscored the need to structurally reform the Federal Reserve System to make a more democratic institution responsive to the needs of ordinary Americans, not just Wall Street CEOs.

"It is a blatant conflict of interest for Jamie Dimon, the CEO and chairman of JPMorgan Chase, to serve on the New York Fed's board of directors," Sanders said. "If this is not a clear example of the fox guarding the henhouse, I don't know what is."

"Allowing bank presidents to play such an important role at the Fed - the institution that regulates their industry - is a conflict of interest, plain and simple, and it must come to an end. This legislation will help restore the confidence of the American people that the Fed is a truly independent entity," Boxer said.

The Federal Reserve is responsible for both supervising the financial services sector and deciding whether to provide bank holding companies low-interest loans through the discount window.

Under current law, two-thirds of the Federal Reserve Bank board members are directly appointed by the financial services industry and one-third of the Fed directors are employed in the financial services industry that the Fed is in charge of regulating.

Under the legislation, no one who works for or invests in a firm eligible to receive direct financial assistance from the Fed would be allowed to sit on the Fed's board of directors or be employed by the Fed.

The measure also would prohibit Federal Reserve employees or board members from owning stock or investing in companies that the Fed oversees, regulates and supervises without any exceptions or waivers.

To read Sanders' full statement, click here.

LATEST NEWS

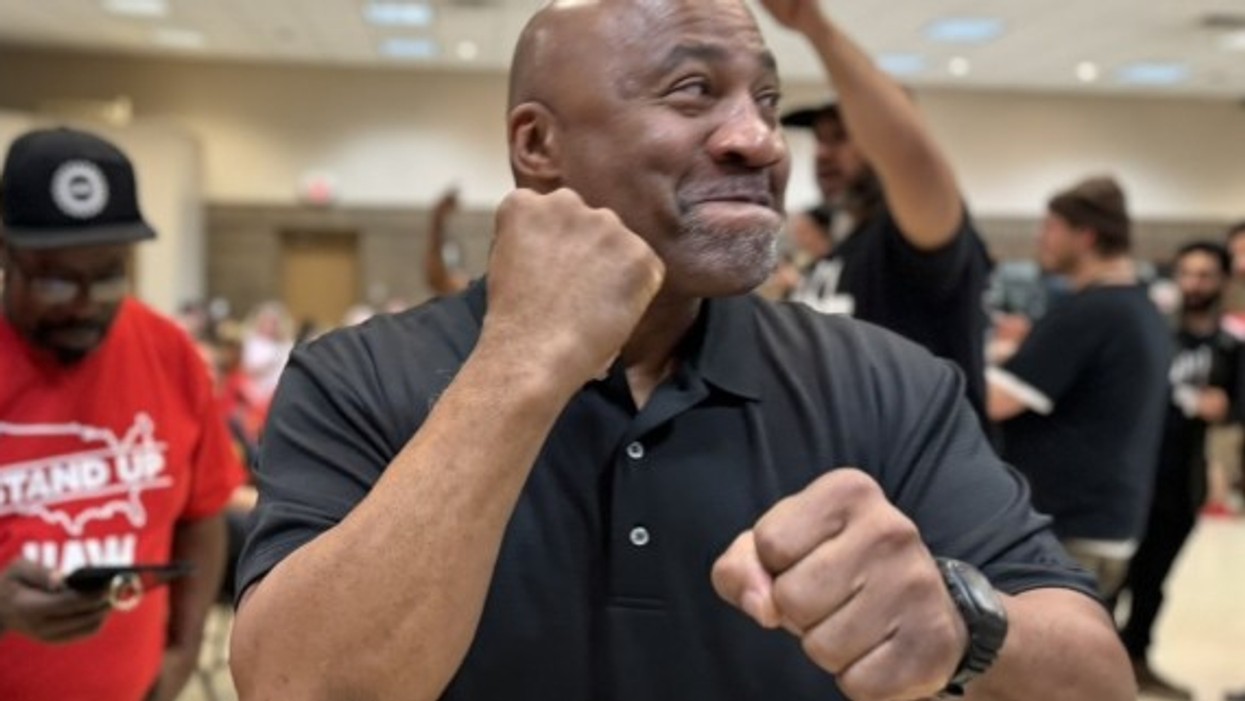

'You All Moved a Mountain': Tennessee Volkswagen Workers Vote to Join UAW

"We're poised to be the first domino of many to fall," one worker at the Chattanooga plant said.

Apr 20, 2024

Workers at a Volkswagen plant in Chattanooga, Tennessee, became the first Southern autoworkers not employed by one of the Big Three car manufacturers to win a union Friday night when they voted to join the United Auto Workers by a "landslide" majority.

This is the first major victory for the UAW after it launched the biggest organizing drive in modern U.S. history on the heels of its "stand up strike" that secured historic contracts with the Big Three in fall 2023.

"Many of the talking heads and the pundits have said to me repeatedly before we announced this campaign, 'You can't win in the South,'" UAW president Shawn Fain told the victorious workers in a video shared by UAW. "They said Southern workers aren't ready for it. They said non-union autoworkers didn't have it in them. But you all said, 'Watch this!' And you all moved a mountain."

"This incredible victory for labor will transform Tennessee and the South!"

According to the UAW's real-time results, the vote tally now stands at 2,628—or 73%—yes to 985—or 27%—no. Voting at the around 4,300-worker plant began Wednesday.

The Chattanooga workers announced their current union drive in December 2023. Friday's victory follows two failed unionization attempts at the plant in 2014 and 2019.

"We saw the big contract that UAW workers won at the Big Three and that got everybody talking," Zachary Costello, a trainer in VW's proficiency room, said in a statement. "You see the pay, the benefits, the rights UAW members have on the job, and you see how that would change your life. That's why we voted overwhelmingly for the union. Once people see the difference a union makes, there's no way to stop them."

The union's win comes despite the opposition of Republican Tennessee Gov. Bill Lee.

"Today, I joined fellow governors in opposing the UAW's unionization campaign," Lee said on social media Tuesday. "We want to keep good-paying jobs and continue to grow the American auto manufacturing sector. A successful unionization drive will stop this growth in its tracks, to the detriment of American workers."

However, Tennessee State Rep. Justin Jones (D-52) celebrated the win.

"Watching history tonight in Chattanooga, as Volkswagen workers voted in a landslide to join the UAW," he wrote on social media Friday night. "Despite pressure from Gov. Lee, this is the first auto plant in the South to unionize since the 1940s. This incredible victory for labor will transform Tennessee and the South!"

Other national labor leaders and progressive politicians also congratulated the Chattanooga workers.

Lee Saunders, president of the American Federation of State, County, and Municipal Employees, said the win "shows what we already know—workers in every part of this country want the freedom to join a union, and when we stand together, we have tremendous power. Even though the deck is stacked against us, momentum is on our side, and we're winning."

Sen. Bernie Sanders (I-Vt.) said: "This is a huge victory not only for UAW workers at Volkswagen, but for every worker in America. The tide is turning. Workers all across the country, even in our most conservative states, are sick and tired of corporate greed and are demanding economic justice."

"I think it's a great push for the entire South, and people will follow suit."

Rep. Alexandria Ocasio-Cortez (D-N.Y.) called the results "an utterly historic victory for the working class."

"Tennessee is shining bright tonight," she wrote on social media Friday. "We are in a new era. Congratulations to the courageous workers in Chattanooga and the entire UAW. Absolutely heroic. Solidarity IS the strategy—across the South, and all over the country."

More Perfect Union said the victory would "change the auto industry, and the future of American labor," and the campaign organizers themselves are aware of the importance of what they've accomplished.

"We understand that the world's watching us," worker Isaac Meadows, who has been at the plant for one year, told More Perfect Union. "You know there's a labor movement in this country, you know, we're poised to be the first domino of many to fall."

Worker Kelcey Smith, who has also been at the plant for one year, added, "I think it's a great push for the entire South, and people will follow suit."

The next domino to fall could be the Mercedes-Benz plant in Vance, Alabama, where a UAW election is scheduled from May 13-17. All told, more than 10,000 non-union car makers have signed union cards since the UAW launched its historic organizing drive.

For the Chattanooga workers, meanwhile, their next big fight will be to secure their first union-negotiated contract.

"The real fight begins now," Fain told cheering workers. "The real fight is getting your fair share. The real fight is the fight to get more time with your families. The real fight is the fight for our union contract."

"And I can guarantee you one thing," Fain continued, "this international unionist leadership, this membership all over this nation has your back in this fight."

Keep ReadingShow Less

Sanders, Booker, and Welch Unveil Ban on Junk Food Ads Targeting Kids

"We cannot continue to allow large corporations in the food and beverage industry to put their profits over the health and wellbeing of our children," said Sen. Bernie Sanders.

Apr 19, 2024

A trio of U.S. senators on Friday introduced what's being billed as first-of-its-kind legislation sponsors say will "take on the greed of the food and beverage industry and address the growing diabetes and obesity epidemics" with a federal ban on junk food ads targeting children.

The Childhood Diabetes Reduction Act—introduced by Sens. Bernie Sanders (I-Vt.), Cory Booker (D-N.J.), and Peter Welch (D-Vt.)—would also require warning labels "on sugar-sweetened foods and beverages; foods and beverages containing non-sugar sweeteners; ultra-processed foods; and foods high in nutrients of concern, such as added sugar, saturated fat, or sodium."

"Let's be clear: The twin crises of type 2 diabetes and obesity in America are being fueled by the food and beverage industry that, for decades, has been making massive profits by enticing children to consume unhealthy products purposely designed to be overeaten," Sanders—who chairs the Senate Health, Education, Labor, and Pensions (HELP) Committee—said in a statement. "We cannot continue to allow large corporations in the food and beverage industry to put their profits over the health and wellbeing of our children."

"Nearly 30 years ago, Congress had the courage to take on the tobacco industry, whose products killed more than 400,000 Americans every year," Sanders added. "Now is the time for Congress to act with the same sense of urgency to combat these diabetes and obesity epidemics. That means banning junk food ads targeted to kids and putting strong warning labels on food and beverages with unacceptably high levels of sugar, salt, and saturated fat."

Booker said that "the future of our nation depends on a continued investment in the health and wellbeing of our children," adding that "more and more of our children are developing diabetes and obesity primarily because a handful of corporate food giants push addictive, ultra-processed foods to drive up their profits."

"By banning junk food advertising to children, implementing front-of-package warning labels, and funding research on the dangers of ultra-processed foods, we can rein in the predatory behavior of big food companies and ensure a healthier future for generations to come," he added.

As the senators noted:

Today, more than 35 million Americans are struggling with type 2 diabetes—90% of whom are overweight or obese. These crises go hand-in-hand and children are severely impacted. Today, 1 out of 5 five kids are living with obesity. A serious illness unto itself, diabetes is also a contributing factor to heart disease, stroke, amputations, blindness, and kidney failure. Unless the U.S. dramatically changes course, these numbers will continue to grow exponentially.

The impact on the economy is enormous: Last year, the total cost of diabetes exceeded $400 billion, approximately 10% of overall U.S. healthcare expenditures.

Meanwhile, the U.S. food and beverage industry spends about $14 billion annually on marketing unhealthy products, with $2 billion of that spent on advertising these products to children.

"Our food environment has become dominated by ultra-processed foods that have more in common with a cigarette than a fruit or vegetable," said Ashley Gearhardt, director of the Food and Addiction Science & Treatment Lab at the University of Michigan. "Many ultra-processed foods are hyperpalatable and trigger the core signs of addiction, like intense cravings and a loss of control over intake."

"The American public is not adequately warned about the risks associated with these products and children are a key marketing demographic for ultra-processed foods with unhealthy nutrient profiles," Gearhardt added. "The Childhood Diabetes Reduction Act is a courageous step towards promoting the physical and mental health of American children."

Keep ReadingShow Less

Complaints of Pregnant Patients Denied Emergency Care Surged After Dobbs

"MAGA abortion bans deny women lifesaving care," one critic said in response to reporting on patient stories.

Apr 19, 2024

New reporting from The Associated Press that complaints of pregnant patients turned away from emergency departments "spiked" after the reversal of Roe v. Wade sparked fresh condemnation of efforts to restrict abortion rights on Friday.

Since the right-wing U.S. Supreme Court ended nearly half a century of nationwide abortion rights with Dobbs v. Jackson Women's Health Organization in June 2022, over 20 states have enacted new restrictions on reproductive healthcare, creating a culture of confusion and fear at many medical facilities.

Early last year, the AP submitted a public records request for 2022 complaints filed under the Emergency Medical Treatment and Active Labor Act (EMTALA), a federal law that requires hospitals and emergency departments that accept Medicare to provide screenings to patients who request them and prohibits refusing to treat individuals with an emergency medical condition.

"This is the reality that extreme Republicans call 'pro-life.'"

"One year after submitting the request, the federal government agreed to release only some complaints and investigative documents filed across just 19 states," the AP's Amanda Seitz reported. "The names of patients, doctors, and medical staff were redacted from the documents."

"One woman miscarried in the lobby restroom of a Texas emergency room as front desk staff refused to admit her," the journalist detailed. "Another woman learned that her fetus had no heartbeat at a Florida hospital, the day after a security guard turned her away from the facility. And in North Carolina, a woman gave birth in a car after an emergency room couldn't offer an ultrasound. The baby later died."

According to Seitz:

Emergency rooms are subject to hefty fines when they turn away patients, fail to stabilize them, or transfer them to another hospital for treatment. Violations can also put hospitals' Medicare funding at risk.

But it's unclear what fines might be imposed on more than a dozen hospitals that the Biden administration says failed to properly treat pregnant patients in 2022.

It can take years for fines to be levied in these cases. The Health and Human Services agency, which enforces the law, declined to share if the hospitals have been referred to the agency's Office of Inspector General for penalties.

Responding to the reporting on social media, journalist Jane Mayer declared, "This is barbaric."

Texas Poor People's Campaign said that women in the state "are being left to die in ER waiting rooms. We cannot let this policy violence against women continue. Please join us as we mobilize voters for the '24 election."

Going into November, abortion has been a key issue at the state and federal level. Supporters of reproductive freedom are working to advance various ballot measures while Democratic President Joe Biden's campaign has highlighted his support for abortion rights and the presumptive Republican nominee, former President Donald Trump, has bragged about his role in reversing Roe—he appointed three of the six justices behind the majority opinion.

"MAGA abortion bans deny women lifesaving care," stressed Alex Wall, senior vice president for digital advocacy at the Center for American Progress. Citing examples from Texas and Florida in the AP report, he reiterated, "MAGA Republicans did this."

Congresswoman Becca Balint (D-Vt.) said that "this is the reality that extreme Republicans call 'pro-life'—pregnant women being turned away at hospitals and emergency centers. Absolutely disgraceful. No woman should ever be denied emergency care."

Slate's Mark Joseph Stern, who covers U.S. legal battles, noted that this "devastating and timely story" from Seitz comes "just days before the Supreme Court considers whether emergency rooms can legally force patients to the brink of death before terminating a failing pregnancy."

The high court is set to hear arguments in that case Wednesday. The Biden administration is challenging Idaho's near-total ban on abortion, which "would make it a criminal offense for doctors to comply with EMTALA's requirement to provide stabilizing treatment, even where a doctor determines that abortion is the medical treatment necessary to prevent a patient from suffering severe health risks or even death," as the U.S. Department of Justice's lawsuit explains.

The Justice Department is seeking a judgment that Idaho's law is invalid under the supremacy clause of the U.S. Constitution and "is preempted by federal law to the extent that it conflicts with EMTALA."

Keep ReadingShow Less

Most Popular