December, 10 2009, 12:29pm EDT

Ginnie Mae's Troubling Endorsements

Little-known Federal Agency Backed Dozens of Lenders with Checkered Pasts

WASHINGTON

t

least 36 mortgage companies with histories of civil suits, reckless

lending, fines, or other sanctions from regulators have for years

received the blessing of Ginnie Mae, the government's huge mortgage

guarantor, according to a new collaborative investigation by the Center

for Public Integrity and The Washington Post. The story, "Ginnie Mae's Troubling Endorsements," features an interactive database of troubled mortgage firms that have been endorsed by Ginnie Mae.

Ginnie Mae authorizes

lenders to bundle mortgages into securities and sell them to investors

- backed by U.S. taxpayer funds. More than a dozen lenders with Ginnie

Mae's endorsement have made loans that are now delinquent at rates far

in excess of what regulators consider acceptable, according to the

investigation. Sixteen of the lenders have been cited by various

federal regulators for unsafe banking practices, insufficient capital,

or other violations.

The Department of Housing

and Urban Development's inspector general says Ginnie Mae is too

accommodating of problem lenders and Ginnie Mae's outside auditor

recently reported a "significant deficiency" in the agency's internal

controls.

The Center for Public Integrity is a nonprofit organization dedicated to producing original, responsible investigative journalism on issues of public concern. The Center is non-partisan and non-advocacy. We are committed to transparent and comprehensive reporting both in the United States and around the world.

LATEST NEWS

'Damning' Independent Probe Finds Israel Has Yet to Provide Evidence Against UNRWA

The U.S. House on Saturday passed a bill including a prohibition on funding the agency, due to Israel's unsubstantiated claims that UNRWA employees have terrorism links.

Apr 22, 2024

Countries that have continued to suspend their funding of the United Nations' top relief agency in the occupied Palestinian territories were left with "no room" to justify their decision, said critics on Monday as an independent investigation into Israel's allegations against the organization revealed Israeli officials have ignored requests to provide evidence to support their claims.

Catherine Colonna, the former foreign minister of France, released her findings in a probe regarding Israel's claims that a significant number of employees of the United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA) were members of terrorist groups.

Nearly three months after U.N. Secretary-General António Guterres commissioned the report, Colonna said Israel "has yet to provide supporting evidence" of its allegation that "a significant number of UNRWA employees are members of terrorist organizations."

Colonna's findings were bolstered by an investigation led by the Raoul Wallenberg Institute of Human Rights and Humanitarian Law in Sweden, the Chr. Michelsen Institute in Norway, and the Danish Institute for Human Rights, which separately sought evidence from Israel.

"Israeli authorities have to date not provided any supporting evidence nor responded to letters from UNRWA in March, and again in April, requesting the names and supporting evidence that would enable UNRWA to open an investigation," said the Nordic groups.

The reports come nearly three months after Israel made its initial allegation that 12 UNRWA employees took part in the October 7 Hamas-led attack on southern Israel, a claim that prompted the United States—the largest international funder of the agency, which subsists mainly on donations—to swiftly halt its funding. Israel also claimed that as many as 12% of UNRWA's employees were members of terrorist organizations.

As Common Dreamsreported at the time, Israel's announcement came hours after the International Court of Justice (ICJ) issued a preliminary ruling that found Israel was "plausibly" committing a genocide in Gaza by relentlessly striking the enclave and blocking almost all humanitarian aid to its 2.3 million people.

The Biden administration has dismissed the ICJ's finding.

The United States' suspension of UNRWA funding set off a domino effect, leading at least 15 countries to freeze their contributions, even though the U.N. had reported a month earlier that Israel's air, land, and sea blockade on Gaza was pushing hundreds of thousands of civilians into starvation.

Countries including Sweden, Japan, France, and Australia have reinstated their funding of the agency in recent weeks, citing concerns about the intensifying humanitarian crisis in Gaza—where more than two dozen children have died of starvation so far—and Israel's lack of evidence.

Lawmakers in the U.S., which provides nearly $344 million to UNRWA annually, included a prohibition on funding for the agency in its foreign aid bill that passed in the House of Representatives on Saturday, while the United Kingdom has said it would make a decision about resuming funding after the Colonna report was released.

"The report leaves no room for Britain to justify the continued suspension of funds," said the independent news group Declassified U.K.

Colonna's report, which was accepted by Guterres Monday, noted that UNRWA is more rigorous than other U.N. agencies in its internal oversight of its staff and their neutrality.

"The review revealed that UNRWA has established a significant number of mechanisms and procedures to ensure compliance with the humanitarian principles, with emphasis on the principle of neutrality and that it possesses a more developed approach to neutrality than other similar U.N. or NGO entities," reads the report.

Guterres called on donor countries to "fully cooperate in the implementation of the recommendations" of the report.

"Moving forward, the secretary-general appeals to all stakeholders to actively support UNRWA, as it is a lifeline for Palestine refugees in the region," said the U.N. chief's office in a statement.

Despite the U.K.'s claim that it would review Colonna's report to determine whether to resume funding, The Guardianreported the government was "unlikely" to make a prompt decision based on the findings, as Conservative lawmakers have urged Foreign Secretary David Cameron against doing so.

The continued suspension of donations, said U.K.-based researcher and activist Gary Spedding, "is unjustifiable and at total odds with the rest of our allies (except the USA) who resumed funding."

"Our government has so much to answer for regarding the decision to pause funding without any evidence whatsoever, then sustain that decision even while other allies resumed and Palestinians in Gaza starved and died from sickness and disease, and even now we still haven't resumed," said Spedding. "We must have accountability and answers. Why did the government pause funding to begin with despite no evidence being presented by Israel? Why have we joined in on damaging UNRWA as part of Israel's plan to dismantle it? Why are Palestinian lives and rights worth so little?"

Colonna's report, said Quincy Institute for Responsible Statecraft executive vice president Trita Parsi, is "not only damning for Israel."

"It is also damning for all the Western countries," he said, "that cut funding for UNRWA on mere (now debunked) accusations by Israel."

Keep ReadingShow Less

Led by US, Global Military Spending Surged to Record $2.4 Trillion Last Year

"Can we get some healthcare please, or maybe feed some of the 40 million+ Americans who can't get enough food?" asked the watchdog group Public Citizen.

Apr 22, 2024

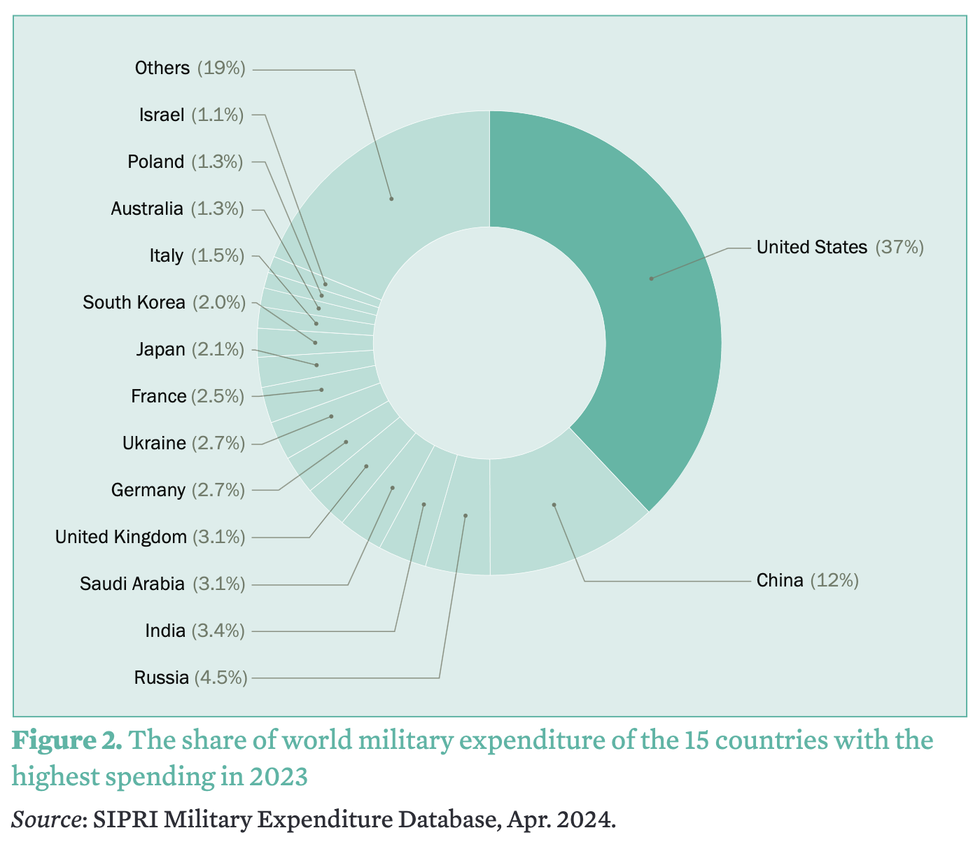

New research published Monday shows that global military spending increased in 2023 for the ninth consecutive year, surging to $2.4 trillion as Russia's assault on Ukraine and Israel's war on the Gaza Strip helped push war-related outlays to an all-time high.

The Stockholm International Peace Research Institute (SIPRI) recorded military spending increases in every geographical region it examined last year, from Europe to Oceania to the Middle East. Last year's global increase of 6.8% was the largest since 2009, SIPRI said.

The United States was by far the largest military spender at $916 billion in 2023, up 2.3% compared to the previous year. The next biggest spender was China, which poured an estimated $296 billion into its military last year—three times less than the U.S.

"Can we get some healthcare please, or maybe feed some of the 40 million+ Americans who can't get enough food?" asked the watchdog group Public Citizen in response to SIPRI's report, which found that the U.S. accounted for 37% of the world's total military spending last year.

A separate analysis of U.S. military spending in 2023 found that 62% of the country's federal discretionary budget went to militarized programs, leaving less than half of the budget for healthcare, housing, nutrition assistance, education, and other domestic priorities.

Together, SIPRI found, the top five biggest military spenders last year—the U.S., China, Russia, India, and Saudi Arabia—accounted for 61% of global military outlays.

"The unprecedented rise in military spending is a direct response to the global deterioration in peace and security," Nan Tian, senior researcher with SIPRI's Military Expenditure and Arms Production Program, said in a statement. "States are prioritizing military strength but they risk an action-reaction spiral in the increasingly volatile geopolitical and security landscape."

In the Middle East, military spending jumped by 9% last year—the highest annual growth rate in the past decade. Israel, which relies heavily on weapons imports from the U.S., spent 24% more on its military last year than in 2022, according to SIPRI, an increase fueled by the country's devastating assault on Gaza.

SIPRI found that NATO's 31 member countries dumped a combined $1.3 trillion into military expenditures in 2023, accounting for 55% of the global total.

U.S. military spending, which is poised to continue surging in the coming years, made up 68% of NATO's 2023 total.

Keep ReadingShow Less

IDF Kills 18 Children in Rafah Hours After US House Approves Billions in Military Aid

"Members of Congress should understand that approving more military aid could subject them to personal liability for aiding and abetting an ongoing genocide in Gaza."

Apr 22, 2024

Hours after the U.S. House approved legislation that would send billions of dollars in additional military aid to Israel, the country's forces killed nearly two dozen people in Rafah, the southern Gaza city where more than half of the enclave's population is sheltering.

Gaza health officials said Sunday that the weekend strikes on Rafah—a former "safe zone" that Israel has been threatening to invade for weeks—killed 22 people, including 18 children. The Associated Pressreported that the first of the Israeli strikes "killed a man, his wife, and their 3-year-old child, according to the nearby Kuwaiti Hospital, which received the bodies."

"The woman was pregnant and the doctors saved the baby, the hospital said," AP added. "The second strike killed 17 children and two women from an extended family."

Israeli forces have killed more than 14,000 children in Gaza since October, but the Biden administration and American lawmakers have refused to back growing international calls to cut off the supply of weaponry and other military equipment even as U.S. voters express support for an arms embargo.

The measure the House approved on Saturday includes $26 billion in funding for Israel, much of which is military assistance.

"Just a day after the House voted to send $14 billion in unconditional military funding to [Israeli Prime Minister Benjamin] Netanyahu's campaign of death and destruction, he bombed the safe zone of Rafah AGAIN, killing 22 Palestinians, of which 18 were CHILDREN!" U.S. Rep. Delia Ramirez (D-Ill.), one of the 58 House lawmakers who voted against the legislation, wrote on social media late Sunday.

"History books will write about today and the past seven months, and how our nation's leaders lacked the courage and moral clarity to stand up to a tyrant," she added. "Shameful."

The military aid package for Israel now heads to the U.S. Senate, which is set to consider the bill early this week. U.S. President Joe Biden, who has continued to greenlight arms sales to Israel amid clear evidence of war crimes, is expected to sign the measure if it reaches his desk.

"Rather than sending more weapons to Israel, Congress should declare an immediate arms embargo on Israel."

U.S. law prohibits "arms transfers that risk facilitating or otherwise contributing to violations of human rights or international humanitarian law," according to a White House memo issued in February. The U.S. State Department has said repeatedly that it has not found Israel to be in violation of international law, a position that runs directly counter to the findings of leading humanitarian organizations and United Nations experts.

The investigative outlet ProPublicareported last week that a "special State Department panel recommended months ago that Secretary of State Antony Blinken disqualify multiple Israeli military and police units from receiving U.S. aid after reviewing allegations that they committed serious human rights abuses" prior to the October 7 Hamas-led attack on southern Israel.

"But Blinken has failed to act on the proposal in the face of growing international criticism of the Israeli military's conduct in Gaza, according to current and former State Department officials," ProPublica noted.

Sarah Leah Whitson, executive director of Democracy for the Arab World Now (DAWN), said in a statement Sunday that senators "should reject sending additional weapons to Israel not only because our laws prohibit military aid to abusive regimes, but because it's extremely damaging to our national interests."

DAWN's advocacy director, Raed Jarrar, added that "at a time when Israel is bracing for International Criminal Court arrest warrants against its leaders, members of Congress should understand that approving more military aid could subject them to personal liability for aiding and abetting an ongoing genocide in Gaza."

"Rather than sending more weapons to Israel," said Jarrar, "Congress should declare an immediate arms embargo on Israel."

Keep ReadingShow Less

Most Popular