(Official White House Photo by Pete Souza)

To donate by check, phone, or other method, see our More Ways to Give page.

(Official White House Photo by Pete Souza)

As boisterous threats of the 'fiscal cliff' persist and progressive voices urge President Barack Obama to avoid falling for shortsighted solutions to illusory ultimatums, a group of corporate lobbyists and CEO's going by the name of "The Campaign to Fix the Debt" are set to unleash an onslaught of campaign ads which propose bipartisan 'compromises' to the problem, but in reality would act as a "Trojan horse concealing massive corporate tax breaks that would make our debt situation much worse," according to a new report by the Institute for Policy Studies.

The Fix the Debt campaign, made up of more than 80 CEOs of "America's most powerful corporations," has raised $60 million to lobby for a debt deal that "would reduce corporate taxes and shift costs onto the poor and elderly," including large cuts to social programs such as Medicare and Social security, the report finds.

With 'Fix the Debt' CEOs are trying to "pass themselves off as noble leaders who are willing to compromise in order the save America from financial ruin," but are actually "leveraging the 'Fiscal Cliff'" in order to push age old attempts to avoid paying taxes at the expense of those in need, says report co-authors Scott Klinger and Sarah Anderson.

The campaign's ads are already appearing in places such as The Washington Post's website but are are expected to "fill our airwaves."

The key findings of the report also include:

The group was co-founded by former Clinton White House Chief of Staff Erskine Bowles and former Republican Sen. Alan Simpson, who both co-chaired Obama's "bipartisan" National Commission on Fiscal Responsibility and Reform.

Obama is scheduled to meet with top American CEOs on Wednesday -- including, General Electric CEO Jeffrey Immelt, American Express CEO Kenneth Chenault, Wal-Mart's Mike Duke, Dow Chemical's Andrew Liveris, Chevron's John Watson, among others.

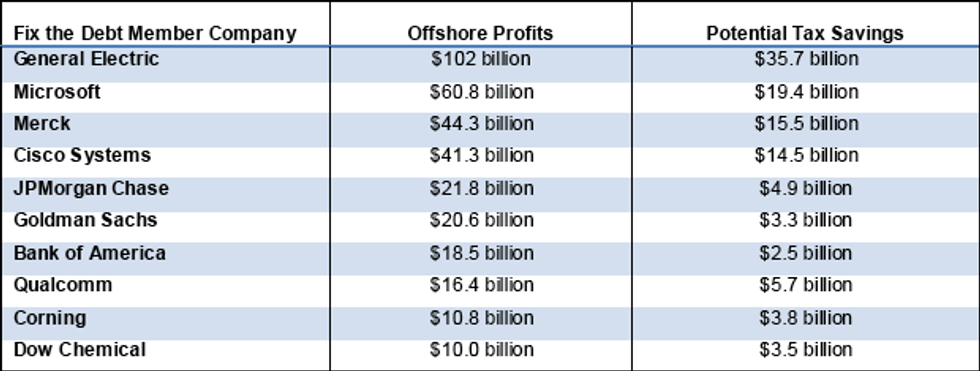

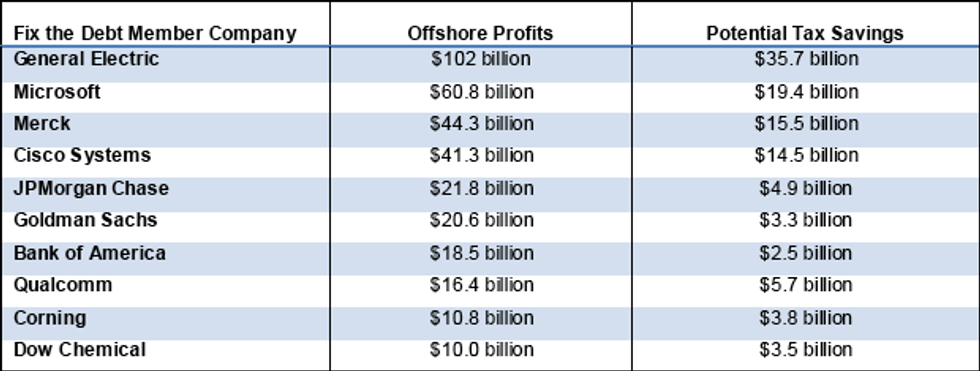

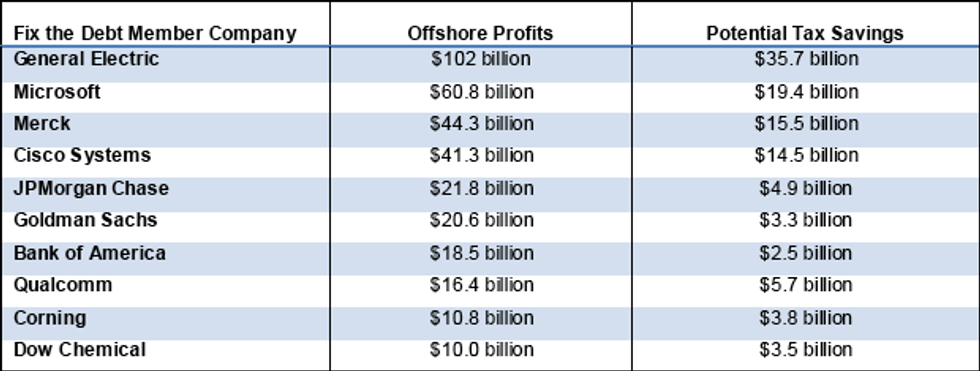

The Campaign's Ten Top Potential Winners from a Territorial Tax System:

Sarah Anderson, director of the Global Economy Project at the Institute for Policy Studies and co-author report appeared on Democracy Now! Tuesday morning:

Common Dreams is powered by optimists who believe in the power of informed and engaged citizens to ignite and enact change to make the world a better place. We're hundreds of thousands strong, but every single supporter makes the difference. Your contribution supports this bold media model—free, independent, and dedicated to reporting the facts every day. Stand with us in the fight for economic equality, social justice, human rights, and a more sustainable future. As a people-powered nonprofit news outlet, we cover the issues the corporate media never will. Join with us today! |

As boisterous threats of the 'fiscal cliff' persist and progressive voices urge President Barack Obama to avoid falling for shortsighted solutions to illusory ultimatums, a group of corporate lobbyists and CEO's going by the name of "The Campaign to Fix the Debt" are set to unleash an onslaught of campaign ads which propose bipartisan 'compromises' to the problem, but in reality would act as a "Trojan horse concealing massive corporate tax breaks that would make our debt situation much worse," according to a new report by the Institute for Policy Studies.

The Fix the Debt campaign, made up of more than 80 CEOs of "America's most powerful corporations," has raised $60 million to lobby for a debt deal that "would reduce corporate taxes and shift costs onto the poor and elderly," including large cuts to social programs such as Medicare and Social security, the report finds.

With 'Fix the Debt' CEOs are trying to "pass themselves off as noble leaders who are willing to compromise in order the save America from financial ruin," but are actually "leveraging the 'Fiscal Cliff'" in order to push age old attempts to avoid paying taxes at the expense of those in need, says report co-authors Scott Klinger and Sarah Anderson.

The campaign's ads are already appearing in places such as The Washington Post's website but are are expected to "fill our airwaves."

The key findings of the report also include:

The group was co-founded by former Clinton White House Chief of Staff Erskine Bowles and former Republican Sen. Alan Simpson, who both co-chaired Obama's "bipartisan" National Commission on Fiscal Responsibility and Reform.

Obama is scheduled to meet with top American CEOs on Wednesday -- including, General Electric CEO Jeffrey Immelt, American Express CEO Kenneth Chenault, Wal-Mart's Mike Duke, Dow Chemical's Andrew Liveris, Chevron's John Watson, among others.

The Campaign's Ten Top Potential Winners from a Territorial Tax System:

Sarah Anderson, director of the Global Economy Project at the Institute for Policy Studies and co-author report appeared on Democracy Now! Tuesday morning:

As boisterous threats of the 'fiscal cliff' persist and progressive voices urge President Barack Obama to avoid falling for shortsighted solutions to illusory ultimatums, a group of corporate lobbyists and CEO's going by the name of "The Campaign to Fix the Debt" are set to unleash an onslaught of campaign ads which propose bipartisan 'compromises' to the problem, but in reality would act as a "Trojan horse concealing massive corporate tax breaks that would make our debt situation much worse," according to a new report by the Institute for Policy Studies.

The Fix the Debt campaign, made up of more than 80 CEOs of "America's most powerful corporations," has raised $60 million to lobby for a debt deal that "would reduce corporate taxes and shift costs onto the poor and elderly," including large cuts to social programs such as Medicare and Social security, the report finds.

With 'Fix the Debt' CEOs are trying to "pass themselves off as noble leaders who are willing to compromise in order the save America from financial ruin," but are actually "leveraging the 'Fiscal Cliff'" in order to push age old attempts to avoid paying taxes at the expense of those in need, says report co-authors Scott Klinger and Sarah Anderson.

The campaign's ads are already appearing in places such as The Washington Post's website but are are expected to "fill our airwaves."

The key findings of the report also include:

The group was co-founded by former Clinton White House Chief of Staff Erskine Bowles and former Republican Sen. Alan Simpson, who both co-chaired Obama's "bipartisan" National Commission on Fiscal Responsibility and Reform.

Obama is scheduled to meet with top American CEOs on Wednesday -- including, General Electric CEO Jeffrey Immelt, American Express CEO Kenneth Chenault, Wal-Mart's Mike Duke, Dow Chemical's Andrew Liveris, Chevron's John Watson, among others.

The Campaign's Ten Top Potential Winners from a Territorial Tax System:

Sarah Anderson, director of the Global Economy Project at the Institute for Policy Studies and co-author report appeared on Democracy Now! Tuesday morning: